While we will agree with some on many things and others on few things, it is safe to say that we will not agree with anyone on everything and will not disagree with anyone on everything.

WARNING: You may not like some of what I have to say, but hopefully we will find some common ground.

![]()

![]()

So what is this page about? Since 1985 (1995 on-line)we have provided services and advice to our clients and readers. However, like most businesses, we have tried to stay neutral or you might say, A-Political. After all, our role as a business is not to represent any kind of political view, it is to help our clients, regardless of their or our viewpoint. Not to mention it is good business not to tick off customers, potential customers, the public or anyone else for that matter.

Are those days over? No, the rest of our web site and our business has not changed. This page on the other hand is different. We are well enough established, plus near enough to retirement (or at least semi-retirement) that we just are not going to let it worry us. Or maybe we are just too old to care anymore.

So, Who am I? My background can be found here. But what am I about? My wife Marian says that I am more than a little bit eccentric. I always thought that I was just an eccentric want to be. But who am I to argue, after all, no one knows me like Marian does. I have been described as right wing of Attila the Hun. I take that as a complement, although I do not know if Attila was right wing or not, and I should specify that that is the fiscal right. I guess you could say that I am a Libertarian, or maybe as one friend puts it, a real libertarian. That is I believe that while there is a place for government, it should be as small as possible and people should be FREE to live as they please as long as it does not interfere with the freedom of others. Also, Freedom of speech and democracy should be defended at all cost, without them there can be no rights or freedom. This means that sometimes we will be offended by what others say and we may not agree with where democracy takes us, but without them it is a slippery slope to tyranny. Now I am getting ahead of myself as that is what the articles are for. One other thing worth noting, as we learn new things and get new information it is important that we be open minded and adjust our opinions when necessary. Sometimes that can appear as waffling, and maybe sometimes it is, but it is essential for growth and progress. After all, we do not know everything, not even close, and some of what we believe will always be wrong.

With all that in mind: Here is what I believe, or at least what I believed when I wrote the Articles, because that too can change.

![]()

![]()

The Death of Free Speech and Professional Ethics (December 21, 2023)

How Many Countries Will There Be in North America in 2050 (September 29, 2023)

Freedom Should be Guaranteed and Protected All Tyranny Needs to End before it gets out of Control (April 5, 2022)

Open Letter to Foothills County Councillors Thank You for Supporting Free Speech and Respectful Dialog. (October 4, 2021)

Canada's Debt, Now What? Where We Have Been, Are Now and May Be Headed. (August 31, 2021)

When the Country Is Broke There will be consequences. (November 22, 2020)

Beware of the Ivory Tower The higher you go the more distorted the view. (October 11, 2020)

Government Employee Pension Plans, My Recommendations (June 1, 2020)

Open Letter to Premier Notley on Kinder Morgan Pipeline (April 15, 2018)

British Columbia Protesters Missed the Rail Car (April 1, 2018)

The Golden Retriever Rule For your entertainment. (December 21, 2016)

From There to Here How I Became a Skeptic of Anthropological (Human) Caused Catastrophic Climate Change (November 3, 2016) (Opens in a new page)

The New Canada Pension Plan Agreement Sort Of (June 22, 2016)

Are You a Climate Change Hypocrite? Take my CO2 challenge, if you care about that. (May 17, 2016)

A Mornings Hunt We never fired a shot, but nonetheless it was a successful morning. (March 25, 2016)

Women may be From Venus and Men may be From Mars, But Entrepreneurs Live on Pluto (February 28, 2016)

Alberta's New Carbon Tax Will Cost Over $1,000 per Albertan Annually Posted December 19, 2015. Updated April 23, 2016 and on January 3, 2017.

TFSA's Benefit the Young, Elderly and Self-Employed the Most (October 5, 2015)

Ontario's Retirement Pension Plan means reduced pensions for many Self-Employed (October 5, 2015)

Canada's Debt, A Liberal Legacy (September 7, 2015)

Corporate Profits, Critical to Your Canada Pension Plan (July 23, 2015)

Correction on Alberta's Health Care Tax, It's even crazier than I thought. Post Alberta election comments added May 21, 2015 and update again on July 16, 2015.

A Tax, Is A Tax, Is A Tax Original comments on the March 26, 2015, Alberta budget.

Apparently, 970,000 Scientists are Missing in Action (March 2, 2015)

Computer Models: The Great Deception (Original post November 25, 2014)

Canada Revenue Agency Must Have Missed the Memo (August 5, 2014)

Canada Revenue Agency's Power Grab (March 23, 2014)

I am Sorry Mr. President, but I did build that! (February 18, 2014)

Seeing Can Be Misleading (Original post 2012)

Comment to my Member of Parliament on Crown Corporations. (sent May 8, 2013)

Letter to my Member of Parliament, On Corporate Taxes, Profits and the Economy (sent October 18, 2011)

![]()

![]()

Get a free subscription to follow Dave on Substack:

Rebel News: Is an online Canadian Independent news source with global coverage. You may agree or disagree with most of their right wing coverage. I usually agree. However, at least they are honest about their bias, unlike the main stream media who pretend to be neutral but in my opinion should be classed as left, lefter and leftist.

The Rebel Cruise 2016: In November of 2016 over 100 like minded people joined The Rebel Staff for the first Rebel Cruise. This is my page about the Cruise.

True North Like The Rebel is an online Canadian Independent news source. You may agree or disagree with most of their right wing coverage. I usually agree. However, at least they are honest about their bias, unlike the main stream media who pretend to be neutral but in my opinion should be classed as left, lefter and leftist.

Small Dead Animals: provides links and readers comments to many different news and non news items on a daily basis. The site has a very large following. It sure bumps my readership when it links to one of my posts. Thanks Kate. But seriously, it is another place to go on a daily basis and get news that the left wing media does not emphasis.

The Fraser Institute: A leading Canadian Think Tank.

The Heartland Institute: An American Think Tank.

The Friends of Science: An independent non-profit organization dedicated to providing insights into Climate Science.

FreedomTalk Conferences: These are exception conferences that take place in Alberta (but you can usually attend virtually) that I highly recommend with some great speakers. You can view past videos on their site.

![]()

![]()

![]()

![]()

December 21, 2023

It is with great sadness that I report to you today that Free Speech in the professions is dying and it is taking professional ethics with it. Some might say they are already dead. I hope not. Before I begin, to set the stage and highlight why this is important, I encourage you to watch my Dave's Professionalism video a 4-and-a-half-minute video that should open in a new tab. It is from my longer Selecting an Accountant video that can be found on Dave's Business Insights. Go ahead, I promise to wait.

In summary, when you select an Accountant, you want to know they will tell you what you need to know, not just what you want to hear. More to the point, in light of the current times, you need to know that they will freely tell you what they believe, uninhibited by what you want to hear or by what others, including their professional bodies or the government wants or demands them to tell you?

This does not just apply to Accountants, it applies to anyone, professional or otherwise who's advice you might rely on. You need to know what they really think. This does not mean they cannot acknowledge what others believe, of course they should acknowledge all the different opinions, but you need to know what they really believe. Maybe you will want to get a second, third or more opinions, and that's okay. Regardless, you not only deserve but you have a right to know their honest opinion.

So where are we now? To tell the truth, when I think about it, I just want to cry. For some time, but especially since early 2020 on many topics we have seen increasing censorship by governments, the professions, the press and others who believe they can get away with it. In the case of regulating bodies (government and professional associations) there are cases of those regulated being told what opinions they can express and what opinions they cannot discuss, regardless of their experience, opinions, any science or other information that they may have. I have to tell you, if my professional association told me that I could not give my honest opinion, I would be very quick to politely tell them … well, you know what. So, what is the motivation? I am not sure if it is about control, money, inflated egos, coverups or just plain stubbornness. In most cases it is probably a combination of motivations. Regardless, it seems clear that this is where we are and it is not only bad, it is unscientific, unprofessional, unethical and just plain WRONG. It is the death of free speech and the death of Professional Ethics.

So how should it work? Those that provide opinions and information that others rely on, plus all decision makers, should always be inquisitive, search for different opinions, new information and review it all with a degree of skepticism. They should also be prepared to change their minds, and admit it when new information arises. This is not weakness or waffling, on the contrary, it is strength. It is also very important that all points of view be available to decision makers and the public. The medical profession has a term "informed consent". Well, if information is being withheld, distorted or is not complete, then there might be consent, but it will not be informed consent. Getting people or the public to consent to go along with something/anything based on incomplete and/or inaccurate information is, and I am repeating myself "not only bad, it is unscientific, unprofessional, unethical and just plain WRONG."

That leads us to what is maybe the most important question: What do we do or is it already too late? I sincerely hope it is not to late and I believe it is not. So here are my thoughts:

A professional's first responsibility is to give the best advice they can to their clients or those they are advising regardless of the opinions or even demands of others. This supersedes what is in their own interest, the interest of those close to them, their relationship with the client or others and even their professional association. This can be hard, we know, we have been there. We have jeopardized, and in some cases, ruined relationships that were important to us, but that is part of being a professional. Frankly, in most, maybe all cases we were better off in the end.

So, I would call on all professionals to always give the best advice they can to their clients or those they are advising regardless of the opinions or even demands of others. This does not mean they do not acknowledge differing opinions, on the contrary, acknowledging other opinions is part of giving the best advice, but it should be accompanied by the professional's honest opinion including informing them of what they do not know, so that those receiving the opinion are fully and properly informed.

Finally, there could be cases where this could mean loss of the ability to give advice due to direction from the government or a professional body, which could also hurt the clients due to the loss of a needed and/or trusted service. In Alberta, it is hard to find a doctor, let alone a good one and I would hate to see my doctor who I really like and respect lose his ability to practice if his opinion differed from that of an ego centric professional body, as this would harm all his patients and his family. If the nuclear option, telling the government or professional body to … well, you know, then I believe the final option is to clearly and honestly state that you are not able to give advice and explain why, for example "the college of …… says that this is what I have to tell you on this regardless of my opinion and I am not allowed to tell you otherwise, so therefore I am not giving you any advice on this, I am just giving you their information. I am sorry, but those are the rules." At least then they will know where they stand.

The leaders, volunteers and employees of our Professional Associations need to get over themselves and recognize that overall, their members who are on the ground in the real world are qualified, have a variety of experience and are often very good at communicating with and learning from each other. These are the things that make a profession strong and effective at dealing with different issues and coming up with new innovative solutions. Why in so many cases do their leadership want to destroy that? Is it because they have overblown egos and are the mediocre ones who want to control the best and the brightest, the ones who are out there doing the job? A professional associations job is to support and enhance their members so that they can be the best they can be. It is not to hold them back and stifle progress.

The professional associations need to understand their role. However, it does not stop there. Their membership needs to keep them in line, hold them to account and when the leadership is holding them back and stifling progress, the membership needs to get its act together and vote them out. Then, and only then, will the professional associations who have lost part or most of the public trust, start to regain that trust.

Our Political Leaders need to understand that they are there to serve the people, not the other way around. They need to take this very seriously. It should not be their role to control and impede progress. While there is always a need for some rules and monitoring, they should be creating an environment that encourages innovation and enhances the lives and opportunities for those that they serve. It is also critical that they protect everyone's rights and freedoms.

I guess it would not be reasonable for me to suggest that we fire everyone and start over, but I can dream. Regardless, I think some serious cutting needs to happen to these huge white elephants, to streamline them making them efficient, effective and to bring them back to the basics.

At the risk of repeating myself: Our government employees also need to understand that they are there to serve the people, not the other way around. They need to take this very seriously. It should not be their role to control and impede progress. While there is always a need for some rules and monitoring, they should be creating an environment that encourages innovation and enhances the lives and opportunities for those that they serve. It is also critical that they protect everyone's rights and freedoms.

Good heavens. What ever happened to the press? I wish I knew. They have totally lost their way. There job should be to challenge everyone, especially those in power, to find and highlight alternate points of view, to show the other side of the story. Now it seems that most of them are just copy writers who mostly sit in their offices regurgitating what they are told by certain select sources. They should be out digging, researching stories and challenging the status quo.

Luckily, despite many governments' best efforts, there are many newer smaller groups cropping up who want to do the real work who are growing and thriving, thanks in no small part to the internet and today's technology. It is easy to see why the legacy media is dying and the newer breed is growing. Let's hope the trend continues.

You may be wondering what you can do. It may not seem like it, but our role is probably the most important one. It is up to us, the public, to make our views and concerns known. To plant seeds and share information with others, even if our network is small. To pave the way for the good leaders to be able to get into power, stay in power and most importantly to do the right things. It is also our job to keep them in line and get rid of them when they stray.

We must stand up for what is right and to quote Ezra Levant, "keep fighting for freedom". Freedom is all we have and if we do not keep fighting for it, tyranny will surely follow and we will only have ourselves to blame.

Editor's Note: The video included near the beginning of this article is part of a longer video from Dave's Business Insights. Links to Dave's Business Insights can be found on heinzegroup.com which is linked from the bottom of this page.

Return to top of page.

Return to Index.

![]()

![]()

September 29, 2023

I have been thinking about this for a while now. One might assume that there are three now and will be in perpetuity, but will there still be three in 2050? I could have picked any year, but 2050 is about a generation away, long enough for today's divisions to create change and for the dust to have settled, or for the divisions to blow over. So, let's take a look at the different possibilities.

I obviously do not know the answer to this question, but I can see different possibilities. I will start with Canada:

For decades now, Quebec has held, and I would say successfully held the risk of separation over Canada's head. What might be most surprising is that we have never taken them up on it, instead we have allowed them all sorts of special treatments, fiscal and political. When you think about its geography, Quebec should be Canada's wealthiest province and the biggest contributor to things like equalization as opposed to being the biggest recipient. It has tremendous resources (hydro, forestry, minerals and yes even petroleum), plus maybe the best positioned province for trade being on the east coast and having the St. Laurence Seaway running through it. I suspect that the only thing really holding them back is all the special treatment, especially fiscal support that they get from Canada, well actually, mainly from Alberta. That leads me to Alberta.

This is a good time to confess my bias. I live in Alberta, but I was not born here and did not grow up here (my wife of 38 years has lived her whole life here), but I have lived here for most of my life and nearly all of my adult life. Alberta is my home and I do not see myself living anywhere else in Canada. Okay, so what about Alberta? I believe Alberta is the most likely to leave, or at least to be the first to leave Canada. It is the most fiscally capable of going it alone, and well we might be reluctant, we keep getting jokers in Ottawa who obviously hate Alberta, probably because of its wealth, spirit and success. One could easily assume that they are determined to drive us out. So, what would that look like? Alberta could go it alone, fiscally it could work, it's population of a little over four million might sound small but it would be larger than about 45% of the countries of the world and would be physically larger than most of the world's countries. However, there are other options. The obvious one would be to join the United States, or to join with some north western states to become a new country. Another, which would be my preference, would be for Saskatchewan to come with us. Ideally, I would also add Northern British Columbia, some of the territories, western Manitoba and maybe the most eastern part of British Columbia. When Canada started, I believe that this area was referred to as Buffalo Country. I would like to name it the Country of Buffalo. Then what?

If Alberta went, taking its wealth with it, what would be keeping Quebec in Canada? Really, it could no longer expect things like equalization support, and as I pointed out, it has the resources to be wealthy on its own. Why would it stay in Canada? Then it begins.

The Atlantic Provinces have always feared Quebec leaving. Trust me, I grew up there. This is because they would be effectively cut off. They could join the United States, form some sort of union with Ontario, or go it alone. I am not sure what they would do. I also cannot help but wonder if they would be better off alone. Atlantic Canada has many great people, ports and resources. I believe that things like equalization and the federal bureaucracy do not really help them but effectively hold them back. In the long run, this could be the best thing that could happen to them. I have left out the possibility of Newfoundland going it alone, I hope not but it could happen. Then there is Ontario. Slow walking, smooth talking...., okay I am getting carried away, I think that might be part of the lyrics of a song.

Under the above scenario: The Prairies would be pretty much gone, I think Winnipeg and eastern Manitoba would wind up joining Ontario, and Quebec would be gone. That leaves two options for Ontario, join the United States or become a new country. Finally, that leaves British Columbia.

Like Ontario, I think it would have two options, join the United States or go it alone. To be honest, for both Ontario and British Columbia both are viable options.

Of course, as can be seen from Hawaii and Alaska, all the parts of a country do not have to be connected, so some sort of a patchwork Canada is another possibility.

So, what about Canada? Realistically I think Canada could be anywhere from one to five different countries in 2050, this could include B.C., Buffalo, Ontario, Quebec and Atlantic Canada.

I cannot speak to the United States (U.S.) in the detail that I can for Canada. While I probably know and understand more about their politics than most Canadians and some have suggested most Americans, it is a much more complex country than Canada and I dare say as a Canadian, I understand Canada better than I understand any other country. I should also note that while technically anyone from North, Central or South America could be referred to as American, when I say American here, I am referring to the United States.

So, what about the United States? I suspect that it will likely remain as one country, but there is growing unrest and uneasiness, especially in some of the more fiscally conservative states who feel they and their opportunities are being more and more controlled by the more socialist states who seem to be trying to take full control (there is a word for that, tyranny) of individual rights, freedoms and ultimately become entrenched in power, apparently in the name of or to protect democracy. Go figure.

This unrest could easily be the beginning of the breakup of the country. In theory, although highly doubtful, each State could go it alone and become its own country. The average size would be around 6.6 million, just ahead of the middle of the pack of all the world's countries. I think it is more likely that new unions would form between like minded States. It could be three main countries, basically, but not exactly: 1: The Northern East coast, 2: The West coast and 3: The middle from the Canadian Border to the Gulf of Mexico (much of which is referred to as "fly over country"). That would leave Alaska and Hawaii. In either case, they might become a new country, or join with one of the unions.

Well, what are the possibilities for the United States? It might remain as one, but breaking up into say three to five new countries is entirely conceivable, and while I would say more than five or at least many more than five is unlikely, it is conceivable.

That leaves Mexico. I really do not know much about Mexican politics and therefore will leave that for others to discuss as any suggestion of mine would be nothing more than speculation without any basis in fact. One might argue, and rightly so, that I would not have a clue about what I was talking about.

Finally, while I see it as unlikely, as opposed to splitting up, countries could merge. Mexico could join the United States, or Canada could join the United States or all three could join. I really do not see these as likely options but they are possibilities, so on the other extreme there could also be as few as one or two countries in North America.

If the countries split up, issues like borders and currency obviously arise which are beyond the scope of this article, except to say that throughout history, around the globe, there have been and are numerous examples of how these can be delt with, from tight control to inter country cooperation. It will be up to each country to determine what works for them. Hopefully the countries will work together to get the best results for all. On a positive note, as the countries will be smaller, as long as democracy is maintained, in reality, not just appearance, governments should be closer and more accountable to the people and therefore closer to the ideal of being by the people for the people. Hopefully!

Again, beyond the scope of this article. However, I would be remiss if I did not point out that one of the most important, probably the most important thing that protected free and democratic countries, like Canada, has been a strong and powerful United States. Many of us have been concerned that in the interest of being woke and popular, much of the recent leadership in the U.S., Europe and Canada too, have been weakening that role and the ability to defend the free world. Regardless of the international structure, if the free world does not get its act together, socialism creep will continue and be followed by communism and tyranny. This great and wonderful experiment of Western Civilization will continue to decline and eventually fall, then, we the people will no longer have a say in our lives, how we live and even what we say.

Return to top of page.

Return to Index.

![]()

![]()

April 5, 2022

Let me start with a simple yet critical premise: For a society to be free and democratic and for it to stay free and democratic, there needs to be basic freedoms and rights for everyone, that are so entrenched into society, into law, that it is impossible or at least near impossible for any government to take away those rights and freedoms, even temporarily. These rights and freedoms must apply to us all, those we agree with and most importantly, those with whom we most strongly disagree. Further, those rights and freedoms that we enjoy, that we take for granted, were fought for by previous generations are worth fighting for. The question is, are we prepared to stand up for those rights and freedoms for everyone and do what it takes to make them absolute now and into the future? What does this mean?

One could argue that no government should ever be able to infringe on anyone's rights. There is an argument for that, but there could also be an argument that there can be circumstances that are so important that on very rare occasions, some infringement might be justified. For the purposes of this piece, I will assume that the latter might be a possibility. However, if any government is ever to infringe on anyone's rights, be it ever so slightly, the reasoning must be there and be so strong that politics will be left completely out of the picture with everyone working together for the common good. So strong that those involved in the process are prepared to drop everything and make this their top, maybe even their only, priority. Finally, so strong that there is a cost to those imposing the restrictions and serious consequences to them if they do not do it right. If these three conditions cannot be met, then I suggest that there is insufficient reasoning for any infringements on anyone's rights, even minor infringements.

The byline of the title of this piece is "All Tyranny Needs to End before it gets out of Control." Sadly, I would argue that the Tyranny in Canada is already out of control and needs to be rolled back, rolled back with a sledge hammer. It has been clear for some time that the goal of many who belong to groups like The World Economic Forum (WEF) is to strip away our rights, freedoms and democracies putting themselves in charge of our lives. Some suggested that to say that was/is a conspiracy theory, however, many of the key people in the WEF are on record as saying this or at least making statements that are so close that their opinions are clear. Up until very recently, many of us have had concerns but were not losing sleep over them, at least not yet. In late 2021, we heard from friends who were in a panic because according to something they read the government could freeze or steal all their assets including bank accounts. My response was that while there are things that worry me, I could not imagine that happening and was not losing any sleep over it. Well, the events of February 2022 with the Truckers Convoy and the Emergency Measures act proved me wrong. So let me be clear, I WAS WRONG and it is now clear to me that we need much stronger checks and balances on all our governments.

The Canadian Charter of Rights and Freedoms includes several rights and freedoms that are supposed to be guaranteed, or so we thought. The following are some of those rights summarized: 2A: Freedom of conscience and religion. 2B: Freedom of thought, belief, opinion and expression (freedom of speech?) including Freedom of the press and other media of communications. 2C: Freedom of peaceful assembly. 2D: Freedom of association. 3: Right to Vote. 6: Mobility rights to enter and mobility rights within Canada. 7: Right to life, liberty, security of person and right not to be deprived thereof. (Freedom of autonomy?) (Freedom to defend one's self or family?). 8: Right to be secure against unreasonable search and seizure. (Right to privacy?). 9: Right not to be arbitrarily detained or imprisoned. 10: Right upon arrest or detention to A: informed promptly of reason. B: retain council without delay and informed of that right. C: have validity of detention determined by way of babeas corpus and be released if not lawful. 11: If charged of an offence the right to A: be informed without delay of the specific offence. B: be tried within a reasonable time. C: Not bear witness against themselves. D: Presumed innocent. E: Right not to be denied bail without reasonable cause. F: Right to jury trial where the maximum punishment is five or more years in prison. 12: Right not to be subject to cruel and unusual treatment or punishment. Note: the question marked items in brackets are things that I believe are important that may or may not fall under the right in question.

It has been pointed out over the years that there are some important rights that are not in the Charter that should be. One of the most important ones that is missing is property rights.

While you might not know or realize it from the reports coming from the Main Stream Media (MSM) who in my opinion are bought and paid for with our tax dollars by the current Federal Liberal Government, it is clear to many of us who are paying attention and following on the ground reporting of many other different sources that governments at all levels have been largely ignoring many of these rights without any serious justification under the guise of "It's an emergency" so no justification is really needed, "Just Trust Us." Well, "We Do Not Trust You." At least not any more. If any government, or anyone for that matter, is going to override any of our rights, first they need to have a really good reason, they need solid evidence/proof to support that reason, it should be very hard to proceed even with a good reason and there needs to be serious consequences for those that abuse the rights of others.

Here are my recommendations for types of laws that should be in place for all governments at all levels. I should note that this is a starting point for discussion, not a final document. My goal here is to suggest and explain what I believe the law needs to accomplish. Things can and should be added, adjusted and reworded. It may be necessary to impose similar laws at the Federal, Provincial and Municipal levels, or maybe only at the Federal or Federal and Provincial levels. These are all questions/details for the Lawyers. Also, by the way, while this is written for Canada, I do not see why any sovereign democratic government would not want to have similar laws in place to protect the rights of their people, those who they are supposed to serve and protect.

With that in mind, here goes:

Anything that infringes on or even appears that it might infringe on any of our rights and freedoms, be it ever so slight, should always be subject to the Charter of Rights and Freedoms. If in the most extreme circumstances it is ever deemed necessary to infringe in any way on those rights and freedoms, then first a specific law must be enacted that meets the following criteria:

These conditions may sound difficult. They are meant to be difficult. It should be non-partisan, no politics involved and it should be very hard to achieve. It is doable, if a situation is serious enough to infringe on anyone's rights, you should be able to get everyone to forget any politics, go above and beyond and follow their conscience. If not, then it is obviously not important enough to be used to limit anyone's rights.

The Laws and Other Requirements:

The Specific Law has to have an end date that cannot exceed 14 days from the start date. At which time it would require a new law and vote for it to continue.

While in place all Members of Parliament take a 50% pay cut. All Government Employees who are not working have their salary reduced to $2,000 per month (inflation adjusted) and those who are working have the amount in excess of $2,000 a month reduced by 50%.

The government can declare a state of emergency without first passing a law, however, if it does it needs to introduce a law covering the state of emergency under the above conditions and the law must be passed by the house within 48 hours and by the Senate within 96 hours. If it is not passed within this time frame, then those rights and freedoms are immediately restored until a law has passed both houses. Further, if it is not passed within the subject time frame, there needs to be significant personal and professional consequences to those who brought in the act, including the Prime Minister, Minister responsible and others. My recommendation is that the Prime Minister and the Minister(s) who brought in the bill will immediately be removed from their post, forfeit their pensions, any further salary and will not be allowed to sit in the House of Commons for five years.

Restitution:

If an organization or individual suffers as a result of the restrictions, unless a court order has been obtained to enforce those restrictions on that organization or individual, they should be able to sue those responsible for damages.

If an individual is incarcerated and not provided due process, (charges laid, right to council, speedy access to bail hearing etc.) then they are entitled to compensation and those denying these rights should be subject to criminal charges.

If a bank account is frozen without a court order for that specific organization or individual, then unless a court order is subsequently obtained, funds frozen will be unfrozen and the party responsible for the freezing shall make further restitution in an amount equal to the amount frozen. If the amount frozen is less than $10,000 then the restitution shall be $10,000. While it might be necessary in certain cases to obtain a court order without representation from all parties, a proper hearing including all parties must be started within seven days.

Anyone or organization including but not limited to Governments, private companies, non-profits or individuals and those representing those organizations or individuals including those in elected positions who are responsible for infringing on the rights of any Canadian, is subject to criminal charges. Essentially what I am saying is it does not matter if you are the Prime Minister, a Minister, a Premier, a Mayor, a board member, an employee or an individual acting on your own, it should be considered an illegal criminal act to infringe on anyone's rights under the Charter and accordingly such acts should be subject to criminal prosecution. This would include those who enact legislation that infringes on those rights.

There also needs to be something in place where if the government/authorities do not ensure any of these rights, citizens can force the issue and take it all the way to the Supreme Court in a speedy manner and at the governments cost. I will leave that to the lawyers to figure out how to do that. In fairness, it will be up to the lawyers to figure all of this out.

Law Enforcement:

Police Officers need the right to be able to and be expected to say no to their superiors without repercussions if they believe that these actions will violate anyone's rights or the actions go against their conscience.

When in uniform (including riot gear) the service (RCMP. City Police, etc.) the officer works for and their badge number should be easily identifiable.

Except when undercover (or in other reasonable circumstances) it should be a criminal offence for an officer to withhold what service (RCMP, City Police etc.) they work for and their badge number.

Whenever possible, every attempt should be made to have events recorded whenever there is concern about confrontations. Obviously the public and the Press also have a right to record events. Complete and accurate records that ensure that the complete and whole truth comes out protect both the public and the officers involved.

Let me conclude with the same simple yet critical premise I started with: For a society to be free and democratic and for it to stay free and democratic, there needs to be basic freedoms and rights for everyone, that are so entrenched into society, into law, that it is impossible or at least near impossible for any government to take away those rights and freedoms, even temporarily. These rights and freedoms must apply to us all, those we agree with and most importantly, those with whom we most strongly disagree. Further, those rights and freedoms that we enjoy, that we take for granted, were fought for by previous generations are worth fighting for. The question is, are we prepared to stand up for those rights and freedoms for everyone and do what it takes to make them absolute now and into the future?

A pdf of the Canadian Charter of Rights and Freedoms

Obtained From the Government of Canada

Return to top of page.

Return to Index.

![]()

![]()

October 4, 2021

On October 2, 2021 I sent a letter to the Councillors of the County of Foothills, in the email that the letter was attached to I wrote:

Please find attached a letter from me thanking those of you who stood up for free speech and are trying to bring people together. These are critical times and sadly I do not remember a time when the community was more divided. It is a time for leaders to find ways to bring the community back together by supporting different opinions, free speech and respectful dialog.

I hope going forward we can all work together to heal all the wounds that have unnecessarily been created over the last year and a half.

The following is the contents of my letter:

I would like to thank those members of Foothills Council and specifically our Reeve who stood up for free speech and the right to question. Regardless of any individual opinions it is clear that Covid is a new area with many unanswered questions and differing opinions. Unfortunately, the formal medical community and many, if not most, governments are supressing discussion and opposing opinions, and as a consequence progress towards solutions. If Doctors and others cannot speak freely, openly and do not challenge the status quo then it is clear that this is not science and more to the point, how are we to trust our doctors and the medical community as a whole.

In early 2014 when I started Dave's Insights web page (http://heinzegroup.com/insight.htm) in the opening I wrote: "Freedom of speech and democracy should be defended at all cost, without them there can be no rights or freedom. This means that sometimes we will be offended by what others say and we may not agree with where democracy takes us, but without them it is a slippery slope to tyranny." At the time I was concerned that our freedoms and specifically free speech were being eroded. Since then, I have watched us continue down this slippery slope, especially recently.

In 2016 in an article titled Women may be From Venus and Men may be From Mars, But Entrepreneurs Live on Pluto in Dave's Insights while referring to Politicians and Government employees I wrote: "Obviously not all but a large number seem to think that our life should be simple, like theirs is. Well, it is not. Then there are the ones, and there are a lot of them, who seem to think that their objective is to find ways to make the business person offside of the rules rather than find ways to work with the business person to help them and make it easier for them to follow the rules. I would have thought that the latter should be the objective." When I was referring to the "not all" in this quote I was thinking about the staff and council of Foothills County (formally MD of Foothills) as in my experience on different occasions I have witnessed how our Councillors and County staff have "found ways to work with the business person to help them and make it easier for them to follow the rules."

As you can guess, for a long time I have appreciated the good work of our Councillors and the County staff. I cannot say that about very many governments. So, when I heard that our Reeve said (which may or may not have been intended for public discussion but finally someone acknowledged it) "The bottom line is people should have a choice to make an informed decision on either side of this without being censored, belittled, coerced or punished. There has to be a way to get through this without violating people." I was once again reminded why I am proud to be a Foothills resident. These issues are tearing people apart, pitting one against another, destroying families and friendships. This is bad for our community, province, country and the world, not to mention the stresses people are feeling are also bad for their health.

These days there are few in Political Life who dare to speak out and encourage free speech and open dialogue. Again, I want to take this opportunity to thank our Reeve and other Councillors for standing up and making an effort to protect everyone's free speech, individual rights, and trying to bring people back together and encourage real progress.

Thank You

You can find information on the Foothills County Councillors here.

Return to top of page.

Return to Index.

![]()

![]()

August 31, 2021

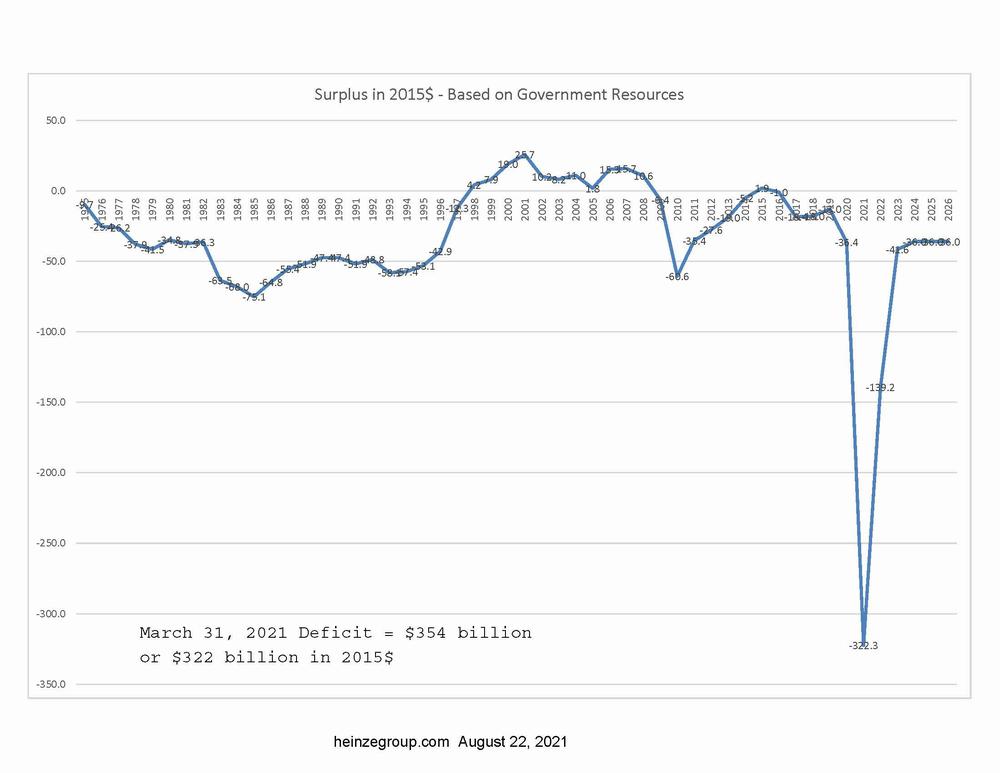

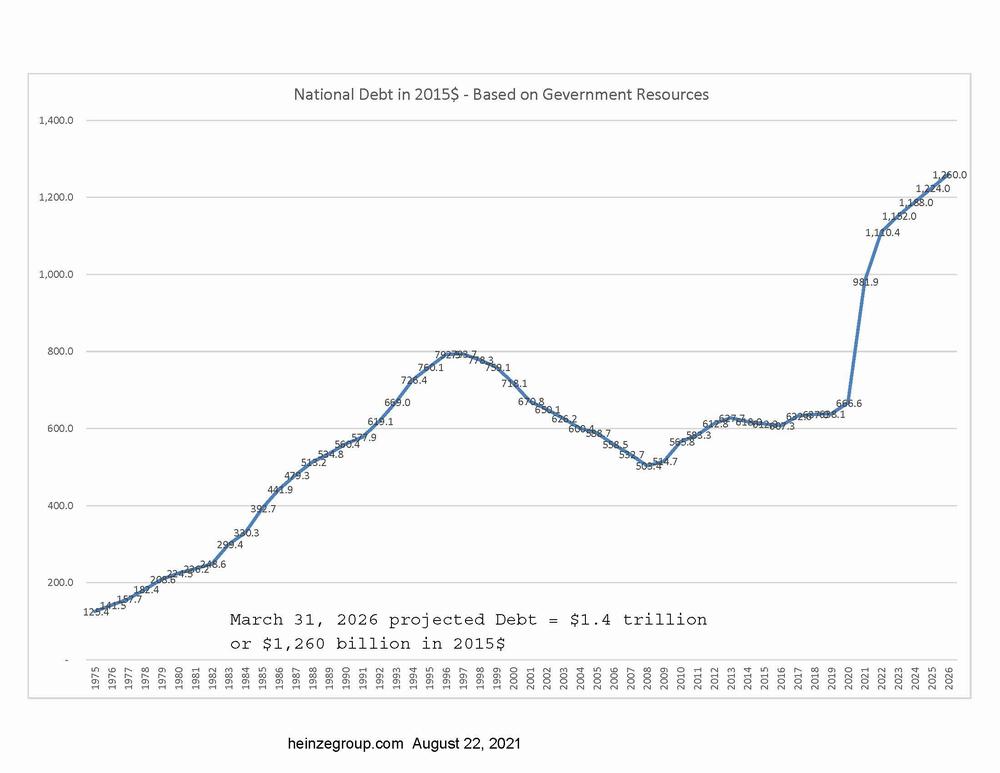

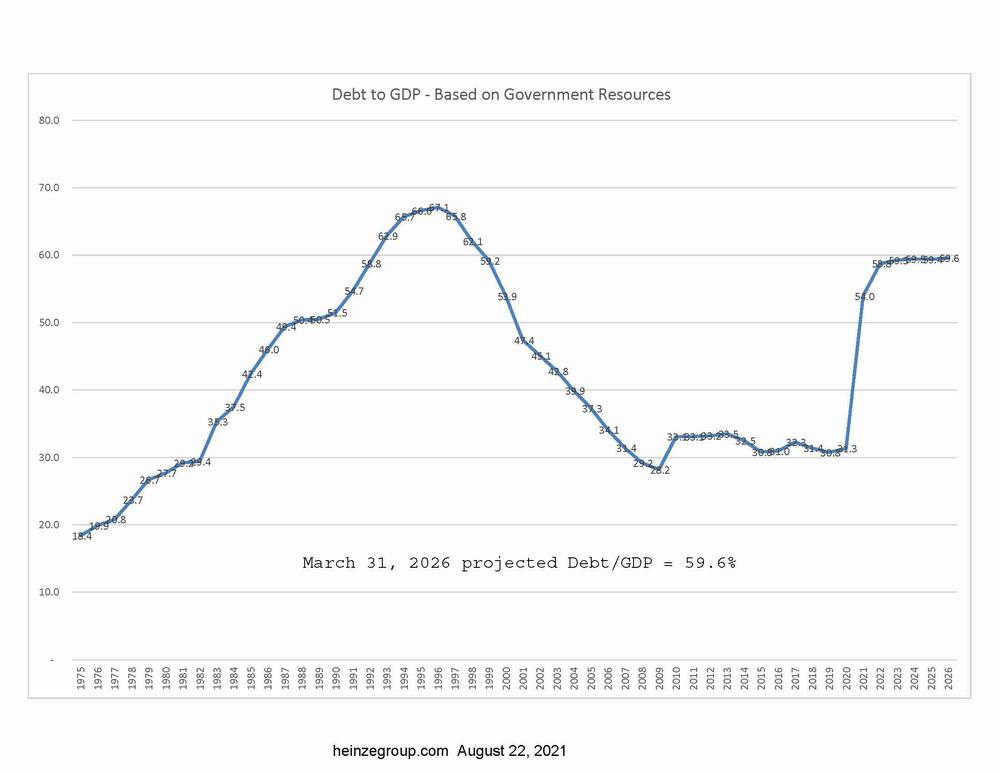

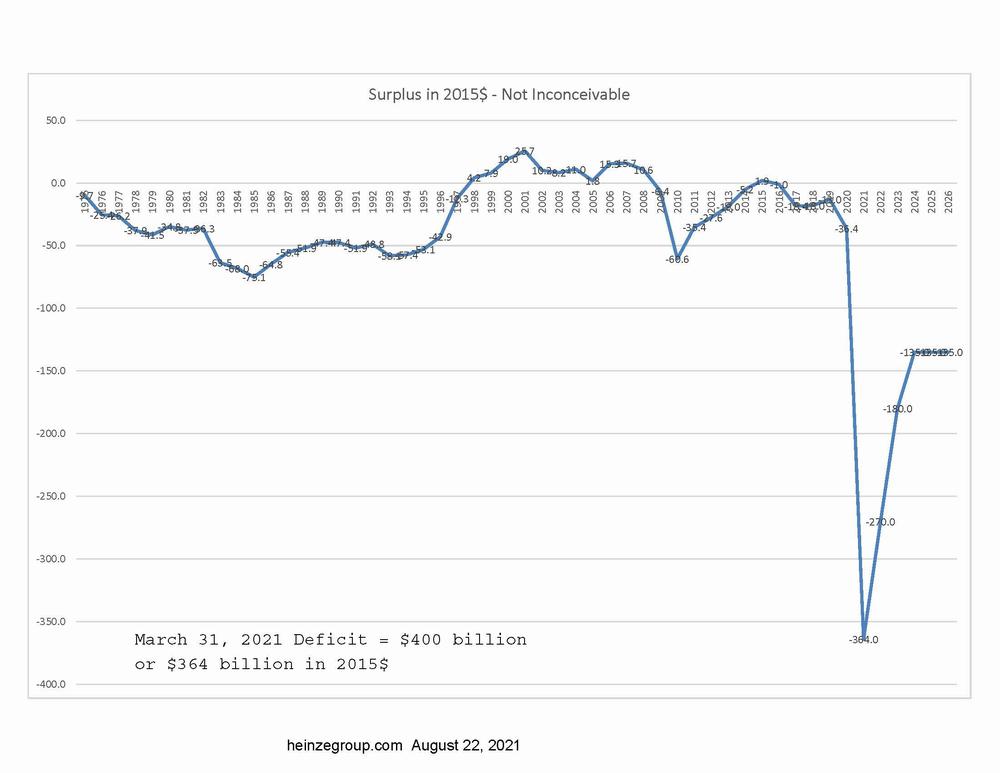

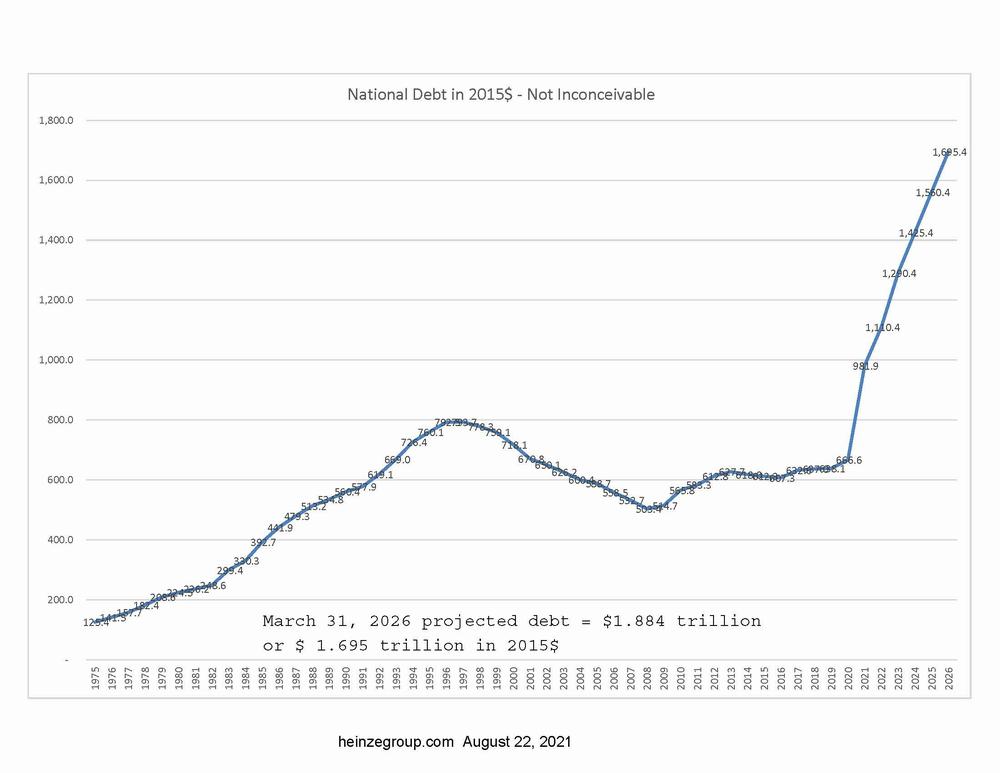

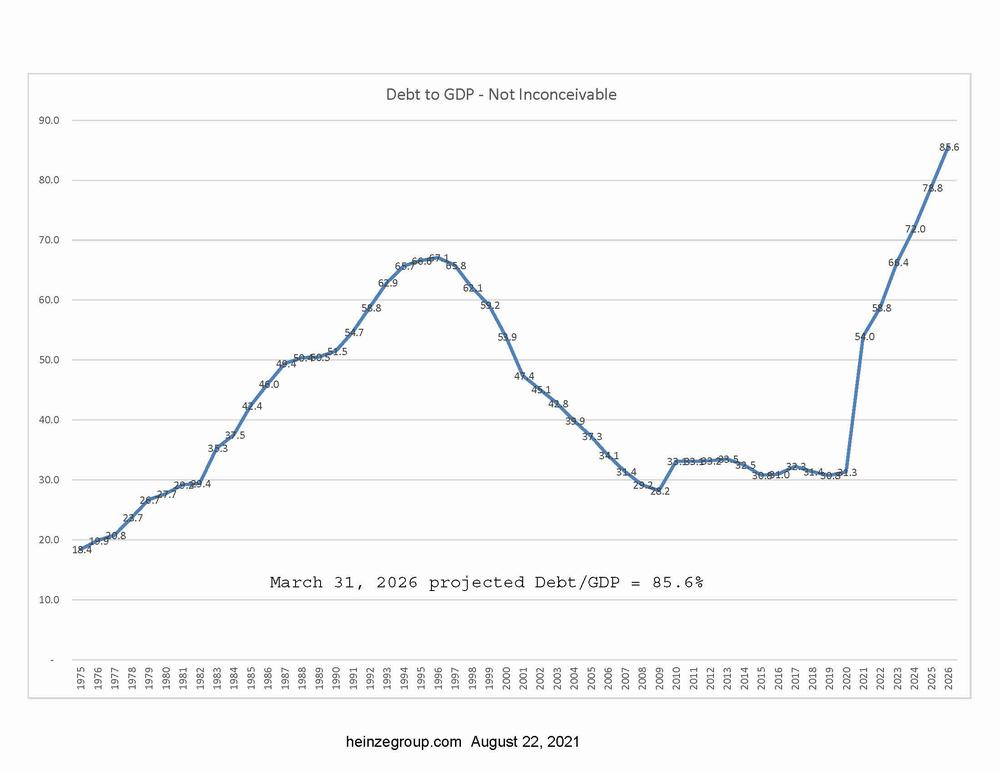

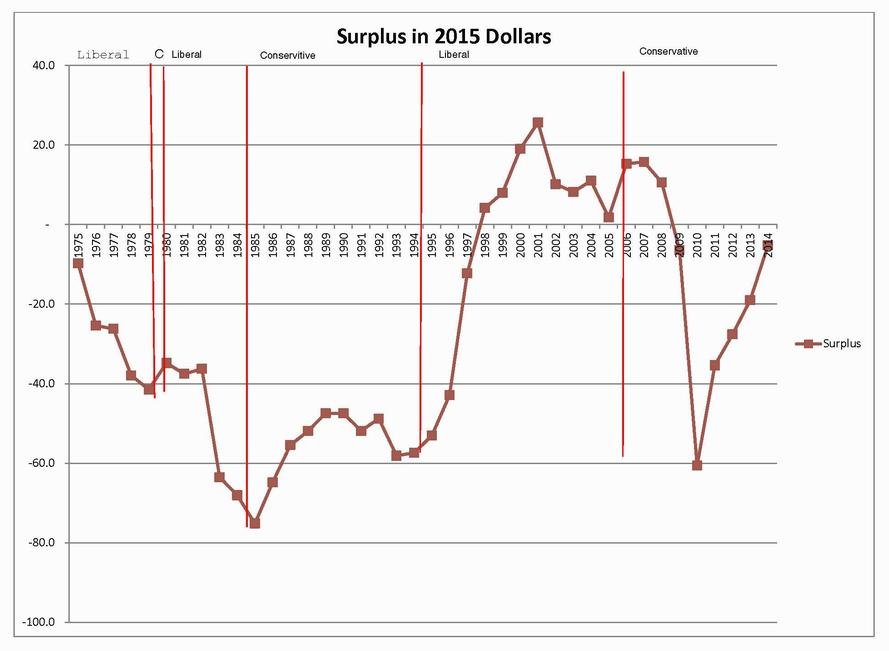

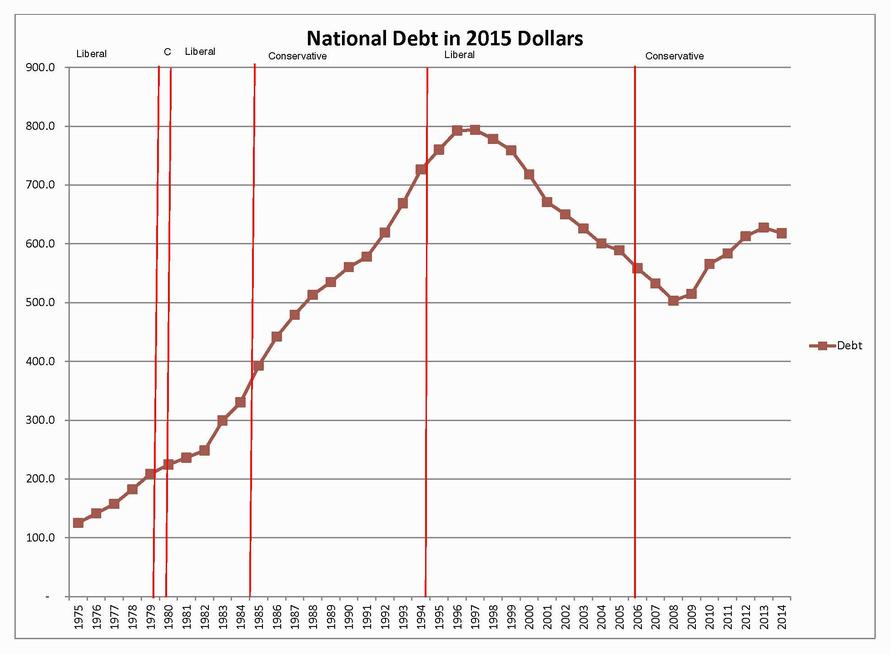

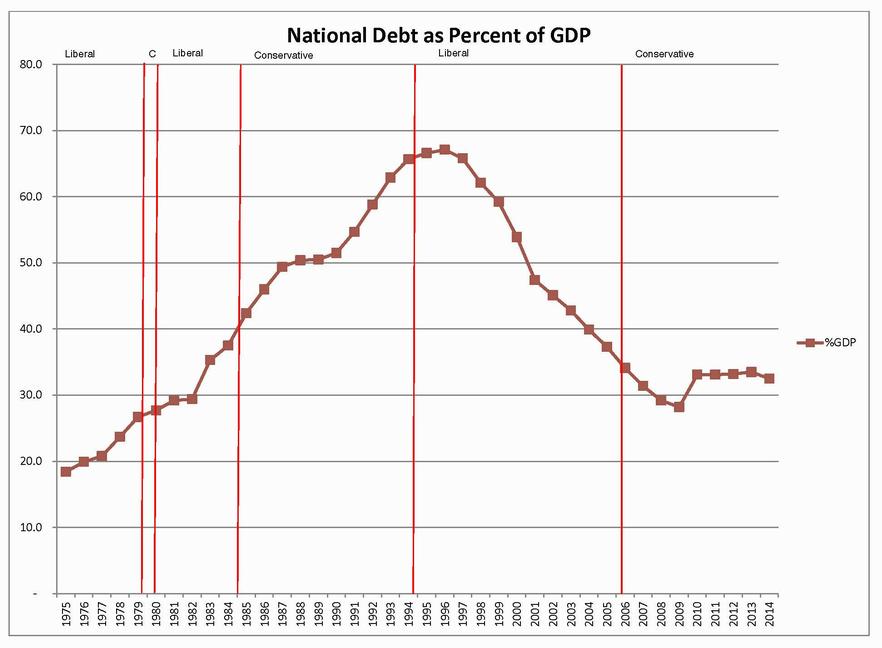

In September of 2015, I wrote an article titled Canada's Debt, A Liberal Legacy. In it I included charts showing Surpluses and Debt for the previous 40 years adjusted to 2015 dollars and the National Debt as a percentage of Gross Domestic Product (GDP) for the prior 40 years. In that article I showed how in 1996 our Debt to Equity peaked at the very concerning rate of 67% and how it had been wrestled down to the 30% range, which was an affordable and manageable level. This is a continuation of that article showing the next 6 years (also adjusted to 2015 dollars) with an analysis of where we are or could be going. If you have not read my 2015 article, I recommend you read it first. Here is a link that should open in a new tab or page: Go ahead, I promise to wait.

Okay, if you went, welcome back, if not let's continue anyway, you can always go back later. While the past is obviously fixed, I will be showing three possible scenarios going forward: In each case there will be three charts. One showing the Federal Surpluses/Deficits from 1975 to 2026 in 2015 dollars. One showing the National Debt from 1975 to 2026 in 2015 dollars. One showing the Federal Debt to GDP from 1975 to 2026. For the years 2021 to 2026 all numbers are my projections. The first scenario is based on the best government numbers I could obtain, or what they are suggesting. The second shows what I believe is the most likely outcome going forward unless the government significantly changes its direction. The final scenario is what could happen if they stick to their guns as much as they can. Then I will give a conclusion with my recommendations. I should also note that the years are based on the government's fiscal year end of March 31. For example, the amounts for 2020 are for the twelve months ending March 31, 2020.

What the Government Suggests

For this section I used the Government's unaudited numbers for the year ending March 31, 2021. The audited numbers will likely come out in October or November, after the election. Then, based on a review of the Parliamentary Budget Officer's report and maybe more so on a recent Fraser Institute article about that report, I assumed they are expecting the debt to reach $1.4 Trillion dollars by March 31 of 2026 in 2026 dollars. In order to come to that total, I assumed a $154.7 billion deficit for 2022, $46.2 billion deficit for 2023 and a $40.0 billion deficit from there onward.

Below is a chart of the surpluses/deficits from 1975 to 2026 in 2015 Dollars. Note that the negative numbers are deficits. As you can see, this assumes a large, slash that, HUGE deficit for the 2021 fiscal year, that quite quickly bounces back to close to where we were before the pandemic. This is a possible scenario, however, to achieve this will require a HUGE attitude adjustment and recognition that the path we are on is NOT sustainable. I will discuss the implications below the other charts.

This next chart shows the Federal National Debt from 1975 to 2026 in 2015 Dollars. By March 31, 2026 we will have pretty much doubled the National Debt since the beginning of the Pandemic. This, by the way, is the optimistic projection.

This last chart shows the debt as a percentage of Gross Domestic Product (GDP). This is the most important chart of the three. It measures how affordable the debt is: When a bank looks at an individual or a business, they may look at what they are currently borrowing, but they will or should concentrate on what is the total amount they are borrowing, the total debt and their income to determine if they can afford the debt. So is the case for a country. In the case of a country, like Canada, we would normally look at its total debt and compare it to its income as measured by its GDP. The question to ask is: What is the debt as a percentage of the country's GDP? Put another way: How does the debt stack up against what the country produces?

As you can see, the debt to GDP has jumped from just over 30% to about 60%. From what I would call the reasonable and affordable range to very concerning range. While this is alarming, as was shown in the late nineties and into the first part of the century, it can be brought under control. I will discuss how in the conclusion part. What most concerns me is that I think this represents the Government's optimistic outlook, and unless there is a HUGE attitude adjustment, this is more like a pipe dream.

Worth noting that as I have been putting this together it appears that the Parliamentary Budget Officer has been looking at campaign promises and revising his projections, and not for the better.

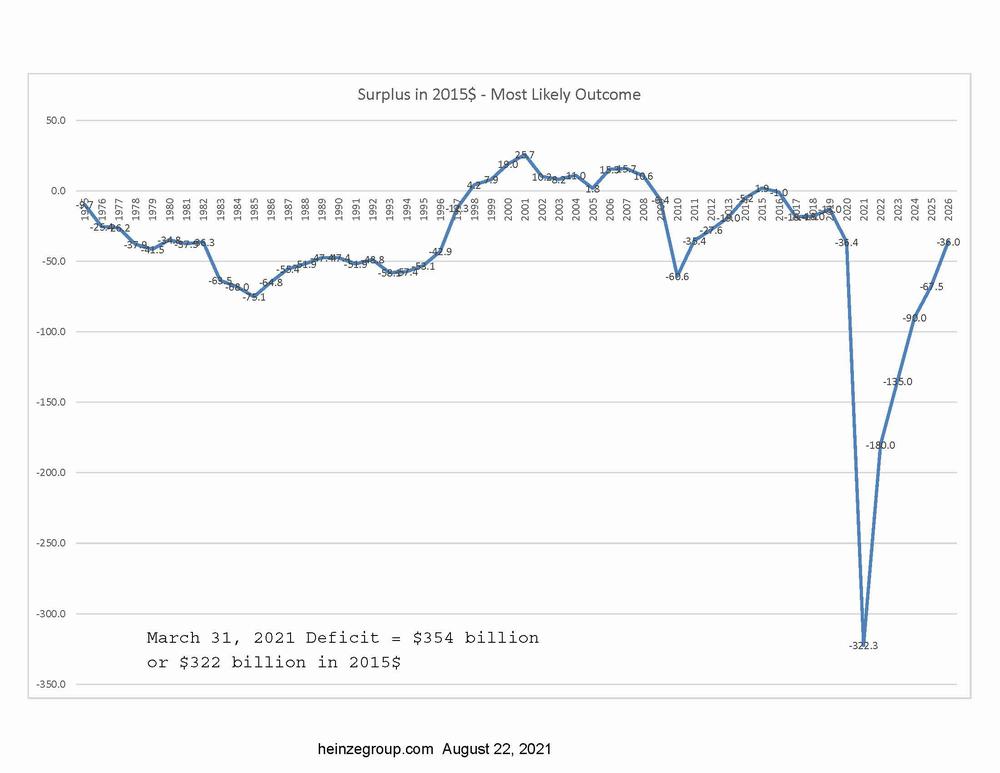

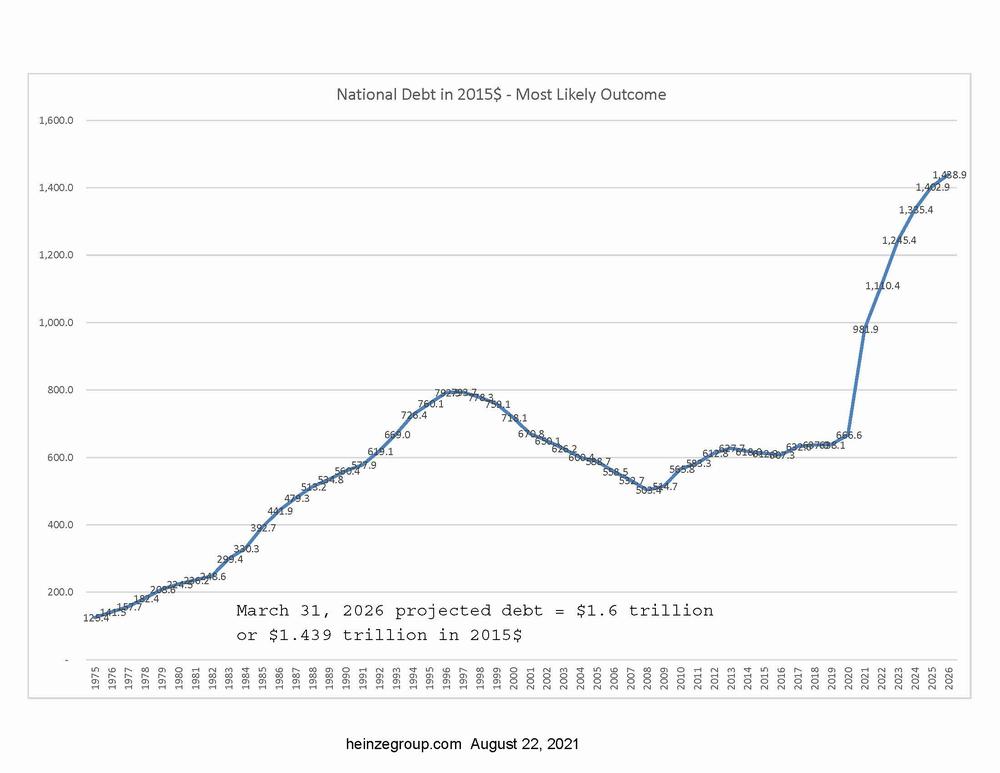

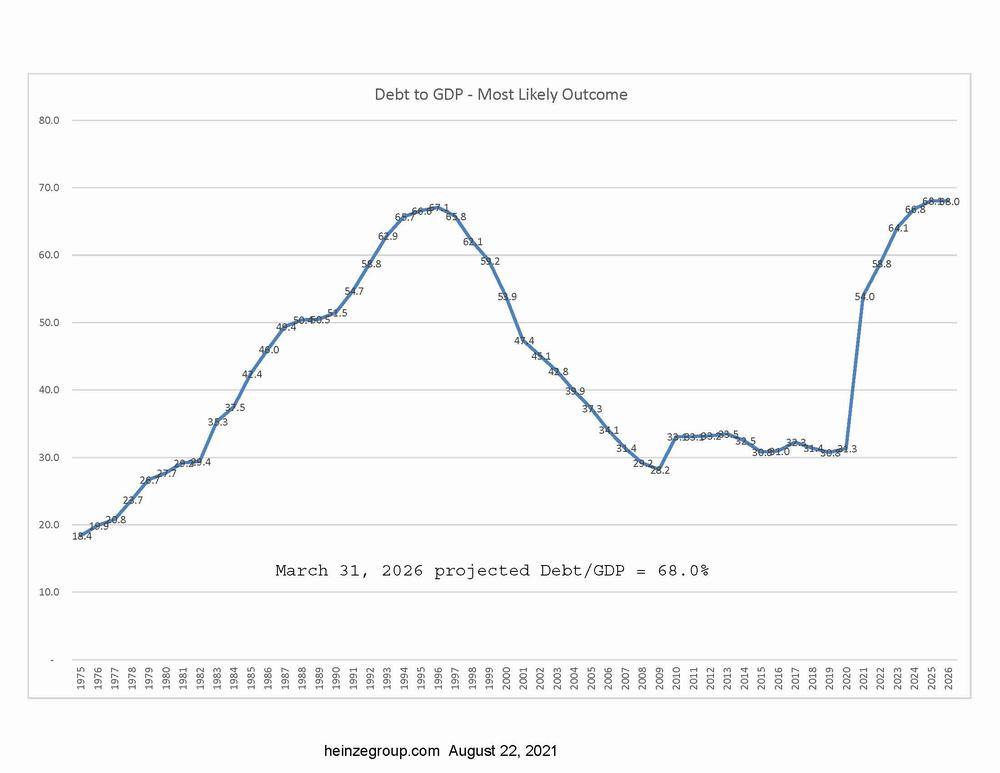

My Expectation or Most Likely Scenario

This next group is based on what I believe is the more likely scenario. I doubt the numbers will be as good as the government would like us to believe, but not as bad as they could be or will be if the government continues on the current path. I believe that this is a more likely scenario, not because the government, or at least the current government does not or would not like to continue on its current path, but because, eventually reality rears its ugly head and when it does, if the government does not smarten up, the public will have had enough and make it so. The sooner the reality sets in the better, otherwise we could be in for the next scenario.

In this case, rightly or wrongly (we will see) I still used the unaudited numbers for the year ending March 31, 2021, then assumed deficits of $200 billion for 2022, $150 billion for 2023, $100 billion for 2024, $75 billion for 2025 and then $40 billion for 2026. In other words, moving back to deficits more like where we were in before the pandemic but at a slower rate. At least with our current ("the budgets will balance themselves") government, this is what I see as likely. Regardless, I hope I am wrong and it is better than this.

Here is the chart of Surpluses/Deficits under this scenario. Again, all in 2015 dollars:

Here is the chart of the National Debt under this scenario. Again, in 2015 dollars.

Finally, here is the chart of Debt to GDP under this scenario.

As you can see, from an affordability point of view in this case the Debt to GDP percentage is similar to what it got to in 1996. This is more serious than in the previous scenario, but while it will not be easy, as shown before it can still be brought under control.

Worst Case but Entirely Possible Scenario

This last group is what I would call the worst case but entirely possible scenario. To be honest, if the current government were to continue as they have and attempt to achieve what they seem to want to achieve, continued lock downs etc. in the naive hope of eliminating Covid rather than learning to live with it, elimination of fossil fuels, guaranteed minimum income for all and other expensive programs etc., then things will be far worse than this scenario. However, I do not think there is much chance of that as I expect reality will rear its ugly head long before that to the point that the public will put an end to it, one way or another. However, while it is avoidable, this scenario is entirely possible.

In this scenario, I assume that the deficit for the twelve months ended March 31, 2021 will be $400 billion ($46 billion worse than we were told). Then the deficit will be $300 billion for 2022, $200 for 2023, and $150 billion per year thereafter. In other words, things will get bad enough that the government will have totally lost control with little chance of fixing it.

Here is the chart of Surpluses/Deficits under this scenario. Again, all in 2015 dollars:

Here is the chart of the National Debt under this scenario. Again, in 2015 dollars.

Finally, here is the chart of Debt to GDP under this scenario.

The most important thing to see here is that the debt as a percentage of GDP will not be leveling off. By 2026 it will be up to 85.6%, closing in on three times the comfortable range with no sign of slowing down. At that rate it would be over 100% by the end of the decade. When do we accept or are forced to accept that the country is broke?

Conclusion Concerns and Recommendations

The article following this one that I posted on November 22, 2020 is titled, When the Country Is Broke.

In it I discussed where we were at that time and what the consequences could be if we do not change course. I also made recommendations of what needed to be done. The consequences are still the same and my recommendations are still the same. Here is what I recommended:

It will not be easy. With more people out of work and more businesses struggling, there will be less tax revenue and increased demand for Government services. Anything that discourages growth like increased regulations and tax rates will slow any growth and most likely result in decreased tax revenue. The more businesses are shut down and the more people are not working the worse it will be. So, increasing taxes will not solve the problem, nor will printing money as that will result in inflation, making the country a less attractive place to invest and will further slow any recovery. At the end of the day, we can only consume what is or has been produced. What to do?

We have to stop the bleeding and get people back to work, they also need to be producing things we need, things of value to create real wealth. The only way that we can do that successfully is for government to create an environment that encourages growth and development by lowering tax rates, cutting spending, reducing excessive regulation (getting out of the way) and above all NO subsidies, let the market run efficiently. The sooner we head on that course, the better our chances of success.

Return to top of page.

Return to Index.

![]()

![]()

November 22, 2020

Recently there is a lot of debate about further shutdowns. The discussion on one side is often around potentially saving lives and overrun hospitals. On the other side is the cost of people losing their livelihoods, losing their homes, depression, suicide, family breakdown, not getting or delaying needed medical treatments and increased drug addictions to name a few. Unfortunately, there seems to be limited discussion on the cost to our economy from increased government debt and what that could mean to all of us in the future. I am going to focus on what the repercussions of excessive government debt might be, something we all need to worry about.

First let us discuss how serious the debt issue is and might become. Probably the best way to measure the affordability of the National Debt is by showing it as a percentage of GDP. In 2015, I wrote an article about the history of Canada's debt. As I show in the article, in the late nineties the Debt to GDP ratio got to just under 70%, which was very high and very concerning. However, as a result of serious fiscal management by about 2005 it was down to below 40% of GDP, a manageable level and at least until 2015 when I wrote the article, it stayed below 40%. So, in early to mid-2020 when it looked like we were going to get back into the 60% range, while I was concerned, I recognized that as long as good fiscal management was followed, reducing spending and keeping tax rates low to create a growth environment, as was proved before, we could fix this, eventually. So, where are we now?

Since the Canadian Federal Government has chosen to keep us in the dark, given itself the ability to do whatever it wants with no accountability and seems to have thrown any sort of fiscal responsibility to the wind, we really do not know where we stand. I think it is fair to say that even if our GDP holds steady and does not shrink from 2019 levels, reaching a Debt to GDP level of 100% or more is not only entirely possible but at the rate we are going it is likely. Can we fix it?

It will not be easy. With more people out of work and more businesses struggling, there will be less tax revenue and increased demand for Government services. Anything that discourages growth like increased regulations and tax rates will slow any growth and most likely result in decreased tax revenue. The more businesses are shut down and the more people are not working the worse it will be. So, increasing taxes will not solve the problem, nor will printing money as that will result in inflation, making the country a less attractive place to invest and will further slow any recovery. At the end of the day, we can only consume what is or has been produced. What to do?

We have to stop the bleeding and get people back to work, they also need to be producing things we need, things of value to create real wealth. The only way that we can do that successfully is for government to create an environment that encourages growth and development by lowering tax rates, cutting spending, reducing excessive regulation (getting out of the way) and above all NO subsidies, let the market run efficiently. The sooner we head on that course, the better our chances of success. What if we fail?

Economic failure CANNOT be an option, yet it is a very real possibility, and getting more real every day. Failure means the country is broke. This is really important with real consequences. Below is a list of some of those real consequences. PLEASE, read them, think about them and share them.

When the Country Is Broke, there will be:

Also, do not forget about the rights and freedoms we take for granted that we could lose if the Government and certain Elites decide that they know best and have to be in control of your life.

Finally, for those employed by the government, as well as the above, while you might still be employed there may be fewer of you, you will have less buying power (either by lower wages and/or by an inflated currency) and you might not have a pension. You will be impacted too.

These are the cold realities which have been experienced in other countries, even recently. Think hard about what kind of country you want to live in and to leave for future generations.

One Final Thought:

I have been called the eternal optimist, it is true, I usually see the glass as half full or better. People often look to me for some optimism when they are most pessimistic. I think optimism is necessary if we want to make positive progress. However, sadly, even with all our wonderful natural resources, lately I am finding it increasingly difficult to be optimistic about our country's future.

Return to top of page.

Return to Index.

![]()

![]()

October 11, 2020

Lately with the virus we are seeing two sides. One is the widely reported WHO, United Nations, Government Official and Political narrative which is based on Computer Models that are continually contradicted by the real world but nonetheless are still accepted as gospel. That side clings to the notion that the world will all but come to an end if we do not do as they say, give up our rights, shut down the planet and cease to live our lives. The other comes mainly from on the ground Doctors and researchers who note that many of these senior government doctors/officials have not seen a patient in years and are not in touch with reality. Unfortunately, many people do not get to hear both sides as the main stream media often only report one side and what we see through social media is influenced by a few multi-media companies that are run at least to some extent by some almost wet behind the ears computer technologists. This also happens with the climate debate, plus I suspect in many other areas.

With all of this, I am reminded of my early days some forty years ago when I was an articling Audit Assistant at the Office of the Auditor General of Canada. During those early days of my career I had the opportunity to participate in the comprehensive audit of the Canadian Penitentiary Service. During the process of that audit our team was broken down into several small groups to look at specific areas. My group of three consisted of a Supervisor, another Audit Assistant and myself. Without going into any detail there is one concept that comes to mind and has stuck with me for all those years. This concept really relates to today's issues.

Here is what we did and how or why this concept made such an impression:

First, for the area that we are looking at, we went to interview the person in charge of that area who was located in the head office in Ottawa. You might say in the Big Ivory Tower. This person was very interesting and told us wonderful things about what was going on and what they were doing in the Penitentiaries. It sounded great.

Next we went to the regional office, you might say the Little Ivory Tower. The person we interviewed there was much more down-to-earth than the one in the head office. But there was still a little bit of the Ivory Tower experience.

Finally, we visited a penitentiary. Well, if our feet weren't firmly planted on the ground before that, let me tell you they certainly were after the penitentiary visit. The Warden and the staff at the penitentiary were very sincere and accommodating, but they live in the real world; they know it and they were quite prepared to tell us how things really work, what is helpful, what is not and why. There was no beating around the bush or party lines, they were very straight shooters. They had to be, and I must admit, we were very impressed; they really earned our respect. This was a great example that I will never forget of how things can seem to those who work in offices or institutions, the Ivory Towers, versus those who are on the ground doing the real work.

So today when I watch what we are being told by politicians and senior government administrators regarding things like the pandemic, I am reminded of those days that I spent with the Office of the Auditor General of Canada. It seems to me that while there may be good intentions by many of these people in the Ivory Tower, they may not be in touch with reality and may fail to see the real picture, leaving many doctors on the ground who are dealing with real patients, real people, very frustrated.

That leads me to make the statement: Beware of the Ivory Tower. The higher you go the more distorted the view.

Return to top of page.

Return to Index.

![]()

![]()

June 1, 2020

As many people are aware, in Canada, government employee pension plans for most Federal, Provincial, and I suspect many Municipalities are very generous defined benefit plans and in many, if not most cases, they are unfunded or underfunded. This leads to different but related major concerns for both Civil Servants and Taxpayers. For the Taxpayer: How am I and future generations going to pay for this? For the Employee, an issue we hear from time to time from Alberta unions: What if the government mismanages or under contributes and there are not sufficient funds to pay the pensions. Not to mention that many Taxpayers, you know the ones paying, feel that the pensions are far too generous, especially when they see career civil servants retire with full benefits at ages like 55, sometimes 50.

So here are my recommendations:

Note: While it is preferable not to, step one could be skipped and the Two Plan Option discussed after item six could be followed.

1: First, the plans have to be made whole, that is fully funded. Like it or not, these were defined benefit plans, that means the government in question guaranteed the employee a certain amount of pension under specified terms. If there are insufficient funds, it is up to the government to make up the difference, if there are excesses, those excesses belong to the government. Then, once the plans are fully funded:

2: Determine what is or would be the government's annual cost of the pensions for each employee, then add that to the employee's salary, and stop contributing to the plans.

3: Give the funds plus control and responsibility of the pension to the unions, who presumably are elected and paid for by the employees to look after their interest, but the employees will get certain options, see item six.

4: The union, under the direction of the members, can decide how much the employees will contribute, what the terms will be, what the options will be and if the plan will be defined benefit or defined contribution.

5: The government, the employer, will withhold the regular contributions from the employees pay and pay that directly to the appropriate administrator.

6: Finally, maybe most importantly, the individual employee will have options. They can have their share of the balance of the plan plus their payroll withholdings paid to the Union plan administrator, to a locked in RRSP (self-directed or otherwise) or to another authorized pension plan. In other words, they will be paying into the plan and will be able to see the full amount as they will be paying for it all (remember we added the employer share to their pay) but it is the individual employee's choice as to how it is invested and by who.

Two Plan Option:

In some cases, a government might believe that it is not possible, practical or would take too long to implement step one and make the plans whole or fully funded. In these cases, I reluctantly recommend that at least to start, they stop the current plans, maintaining them up to their current status and have them vested as if all the employee's employment ended on that date. Then for all future work they could implement steps two to six above. Of course, in these cases, only future withholdings would be transferred to the new plan.

Unfortunately, this two-plan option would not relieve the government for its obligations for past service, however, it would stop any future bleeding.

Conclusion:

This will have several advantages. For the government, they are relieved of any issues with unions etc. regarding funding and management. For the Taxpayer, the ones paying, once the plans are made whole and this is set up, there is no longer a concern about a looming unfunded debt. For the employees, they can see what they are making, what they are paying into their pension (all of it) and decide how and by who their money will be managed. For the Unions, well they might not like it as they will actually be responsible/answerable to their members and will have to hire good managers if they want their members to use their plan(s). If they do not like it, the Unions I mean, too bad, their job is to look after their members, something they often seem to forget while they pursue ways to increase their own power and empires, and they can always be replaced by their members, their bosses.

This is a different approach, and there will be hurtles to start like making underfunded plans whole, however, it is doable, fair to all parties and most importantly, sustainable.

One Final Note: This is a generalized approach. Obviously, in each case the exact terms and conditions would have to be negotiated and worked out.

Return to top of page.

Return to Index.

![]()

![]()

April 15, 2018

Dear Premier Notley

In light of today's talks with the Prime Minister and Premier of British Columbia on the Kinder Morgan Pipeline, and your apparent plan to negotiate with the company to fund the pipeline, I would like to make the following recommendations:

Recommendations:

1: Rather than funding or purchasing the line, which will cause all sorts of issues long into the future, why not treat it like a Government Construction contract in reverse? Let me explain what I mean. It is not uncommon when Governments hire contractors to build in completion date incentives for early completion and/or penalties for late completion. I recommend that you negotiate a deal with the company where for every day the project gets delayed, by any government, court, civil or other action the Government will pay a daily penalty. Moreover, if the project gets canceled there will be a final penalty on top of the daily penalty up to the cancellation date. This way, the company is protected and the Government has an incentive get things moving. Of course the exact terms of the agreement needs be negotiated between the parties.

2: Further to the above, you should make it clear to the Government of British Columbia that when the court delays are settled and they lose, you intend to sue them for restitution for any penalties Alberta pays as a result of these or any other delays caused or facilitated by them.

3: You also should strongly pressure the appropriate authorities to prosecute protesters or others who break the law, to the fullest extent of the law. Legal protests that do not interfere with legal operations, do property damage or harm others are one thing, breaking the law is another.

4: Continue with your plan to introduce legislation to allow you to limit exports to British Columbia and then try to use them in such a way as to make a serious point but not to do any overly serious harm to their infrastructure, economy or long term wellbeing. After all, most British Columbian's are on our side and once this is over we will all want to go back to business as usual.

I could also make recommendations about cancelling the destructive Carbon Taxes that have failed to obtain any social license and eliminating all corporate subsidies, including green subsidies. We already have the highest environmental standards in the world and have been continuing to improve them for generations. However, I will leave those for another day.

I hope you will give my recommendations some serious consideration going forward.

Dave Heinze

Return to top of page.

Return to Index.

![]()

![]()

April 1, 2018

While catching up on my investment reading something occurred to me that I had not really thought about. It had been obvious to me that our major pipeline companies were continuing to invest large amounts to expand their capacity, just not in Canada. The significance of this had not escaped me or no doubt many others. However, the significance of what our major Rail companies were doing had not occurred to me.

I had been aware that Canadian Pacific, a company I follow, had been upgrading its rails and locomotives etc. to improve efficiency and capacity. This has been going on for some time. However, I had not given much thought to how this impacts the Petroleum and Agriculture industry. Moving more oil, especially to the west coast offers significant opportunities to the rail companies, especially since there is insufficient pipeline capacity. What this means to the Petroleum industry is that as long as there is insufficient pipeline capacity they will utilize as much of the rail capacity as they can get, even though it is less safe and more expensive than by pipeline. For the Agriculture industry, it means it is slower, more expensive and more difficult to get their grain to port. For the Rail lines, well it is practically a windfall.

This is where I say that the protesters have missed the rail car. First, the Petroleum industry will use pipelines whenever they can as it is not only safer, but cheaper and more efficient, especially in harsh winters like the last one. But the safety issue is important. In pipelines, spills are rare, especially in the newer pipelines, and when there is spill it is usually small, detected early, and most importantly, while it can be temporarily inconvenient for everyone involved, including the company, it does get cleaned up. The same may go for most rail accidents, but as Lac-Megantic in Quebec showed us, the consequences can be much worse than a spill.

So the protesters in my opinion are missing the rail car. If they really cared about safety, the environment and people, especially the poor, then they would be pushing for more pipeline capacity. Ideally they would want it to exceed production capacity because if it did, usage of rail would be minimized. This would increase safety for those living near or along the rail lines and increase capacity to get grain to the coast. This would benefit our farmers and help provide an affordable and adequate supply of food to the rest of the world, which would especially help the poorest people of the world, not to mention that economically it would benefit all of Canada.

So if the Protesters really cared, especially those living along the transportation corridors, they would be supporting more pipelines and discouraging the use of rail. Also, if they are worried about spills at sea, then they should be protesting all the Oil imported into Canada, not to mention all the other ships going in and out of our ports that are loaded with fuel (usually Bunker Sea Oil) that do not meet the safety standards imposed on the Oil Tankers.

One final question: When and what is the plan to reclaim Vancouver and put it back to nature the way we found it?

For more information on Oil Tanker safety see Oil Tankers in Canadian Waters.

Return to top of page.

Return to Index.

![]()

![]()

December 21, 2016

For your entertainment on the less serious but more fun side. As we cruise into Christmas and through the new year, remember the Golden Retriever Rule:

Have Fun and be Happy.

Return to top of page.

Return to Index.

![]()

![]()

November 3, 2016

Not a skeptic of Climate Change, as long as the Earth has had an atmosphere the climate has changed, sometimes greatly and sometimes very quickly. Nor do I doubt that we humans have had some effect, I am sure we have. The question is how much, and if the effect is overall positive or negative?

So this is my story, written in three parts: Part 1 outlines the journey of how I got to my current opinion, Part 2 outlines what I currently believe and Part 3 gives my recommendations about what we should be doing. At the end I give my confession of my own biases followed by numerous links etc.

Due to its size, this article can be found here on its own page.

Return to top of page.

Return to Index.

![]()

![]()

This plan was adopted.

June 22, 2016

First let's get it straight, from what I can tell, this is not really an agreement nor has it been ratified by Parliament or any Provincial Legislature. It is an agreement in principle to enhance the CPP with a certain outcome in mind. There is little to it, or at least little that is obvious on The Department of Finance web site as of June 21, 2016. Here is a link to the Press Release and a link to the pdf of the 8 sentence agreement. Hopefully the links do not get removed.

So what does it say? Well based on the 8 sentence agreement and the press release here is what I currently believe it says and my comments:

Premiums:

They make it sound small by saying $7 per month for someone earning $55,000 per year. Well that is only the employee portion and only the start, once it is fully phased in, in 5 years, it is expected to be $34 per month or $408 per year for the employee plus another $408 per year for their employer or in total, $816 more premiums per year for someone earning $55,000. This works out to a combined rate of 1.5%. When added to the current 9.9% this means a total premium rate of 11.4% of pensionable earnings. If Ontario goes ahead with their new pension with its combined rate of 3.8%, people in Ontario will be looking at combined premiums of just over 15% of pensionable earnings.

Many Self-Employed are bound to stop taking salaries and start taking dividends instead to avoid the plan altogether, see my October 15, 2015 article Ontario's Retirement Plan Means Reduced Pensions for Many Self Employed below. Employees may think that they will only pay their half but in reality at the end of the day this money has to come from somewhere, and employers only have so much money to cover salaries, so ultimately, while it will not be obvious, it will effectively be paid by employees through reduced salaries (smaller raises) and/or reduced benefits. Or maybe God will pay, but somehow I doubt it.

Maximum Insurable Earnings:

The Upper Limit, which is currently indexed, will be increased at a faster rate with a target of having the upper limit of pensionable Earnings reaching $82,700 by 2025. While that sounds like a lot, it is really only a growth rate of about 4.4% or a little over double recent inflation rates. Not that big a deal but one wonders if the people with incomes in that range or higher are the ones that are likely to retire into poverty.

Pension Income:They have indicated that the goal is to increase the benefit from 25% of pensionable earnings to 33%. They claim that means that someone earning $50,000 constant earnings throughout their working life will receive an additional $4000 per year. Since the first $3500 is not pensionable that works out to paying an additional $698 per year [($50,000-3500)X 1.5%] or $31,410 over 45 years. I have not run the numbers to calculate a return on investment but essentially that means that it will take to age 73 to get your money back with no return on investment and at age 85 you will have gotten $80,000 for your $31,410 investment, some of which will have been invested for over 60 years. Maybe, hopefully, the pay out will be indexed, otherwise what are they planning to do with our money.

That leads me to the last point or concern. As I show in my July 23, 2015 article Corporate Profits, Critical To Your Canada Pension Plan below, while originally there was not a fund, today there is and it is managed in a manner similar to many private plans. If the increased premiums go into the plan and the current approach continues, while it may not be a good deal, at least the Plan should be solvent. However, if the current or a future government decides to raid the plan or direct the invests in a manner that meets some political objective, then all bets are off.

My Recommendations:

Here is what I would recommend they do. I realize that most of this is a pipe dream that the current Government will never implement, but nonetheless this is what I recommend. And hey, I can dream, can't I?

1: Remove the 18% earned income limit while keeping the dollar limit on RRSP's. Make it like TFSA's where everyone over 18 gets the same amount of contribution room. I do not get why they want to limit lower income individuals anyway.

2: Increase the annual limit for Tax Free Savings Accounts back up to $10,000. On the one hand they are claiming that Canadians are not saving enough while at the same time they are reducing one of the available vehicles. Also see my October 5, 2015 article TFSA's Benefit the Young, Elderly and Self-Employed the Most.

3: Leave the Canada Pension Plan as it is, but if the Government really thinks that it must require people to put more away, then allow them the option of putting it into either the Canada Pension Plan or a locked-in RRSP. Ideally, reduce the required Canada Pension Plan amounts but require the difference be put into a locked-in RRSP or into the Canada Pension Plan, again, it should be the individual's choice.

Return to top of page.

Return to Index.

![]()

![]()

Take my CO2 challenge, if you care about that.

May 17, 2016