Return to Financial Insight's main page.

![]()

![]()

Click on an individual date to jump to its outlook, or scroll down through all the Market Outlooks.

January 2009, Another Conversation with Dave Heinze

October 2007, A Conversation with Dave Heinze

January 3, 2000, The Last 20 Years, A Personal History

![]()

![]()

The charts below have been updated to the close of markets on March 20, 2020. Remember, we do not not know the future, in the next while the markets could continue to drop, hold steady or start to recover. No matter what it does it is bound to be bumpy. Hopefully the charts will help to give you some perspective. Regardless, we continue to stress our IFC investment principles.

While I have not posted here for some time, with the recent volatility in the financial markets I felt a little perspective is in order. Below are screen shots of 2 logarithmic (log) charts I built using Yahoo Finance going back to 1986 and ending on March 13, 2020. It is important to use log charts rather than linier charts in a case like this as when the market is say 20,000 a 20% change is 4,000 while when it 2,000 a 20% change is only 400, which means that in this case a similar drop 30 years ago would look flat compared to today. Log charts adjust the scale so that regardless of the scale, a 20% drop looks the same.

First let us look at the Chart of the DOW. When you look at the last 30+ years, the recent drop while significant, especially since it is now, compared to past drops, it is not exceptional. You will see that as drastic as it is, or feels, so far at least it has only dropped to mid-2017 values. More importantly, while we do not know what the future holds, we have seen bigger drops in the past and in the long run the markets recovered. We will tell you from experience, with major corrections, it nearly always feels like the current one is the worst.Looking back to 1987, remember Black Monday, we do, it was even worse than today, or at least today so far. However, by about 1993 all losses had been made back for good. Around 2003 there was another similar drop just not so fast and then a fairly steep and larger drop around 2009. In all these cases the market recovered.

Now, since we are Canadian, let us look at the TSX. While maybe the returns have not matched the DOW, we still see several drops as large or larger as the current drop and while maybe slower than the DOW they are followed by recoveries.

So where to from here?

While the current markets may seem dire and/or scary, based on the last 30+ years, it is hardly unusual or unexpected. However, it always feels like "This is the worse" at the time. We do not know the future, if someone tells you they do, I suggest you run away, and the more certain they are, the more certain I become that you should run away. However, our standard advice remains the same. I continue to stress our four IFC principles.

1: Balance your investments according to your personal circumstances. Not the market or some projection that may or may not be accurate.

2: Always diversify your Investments. The balance may be adjusted according to your circumstances, but the advice stands.

3: Invest in Quality. I cannot stress this enough. The high-quality companies may not seem as exciting, but in our experience they hold their value the best in downturns and usually recover first.

4: Invest regularly and gradually. I might adjust this to say during your investing years, as once you retire this rule is less relevant, but I still suggest that changes usually should be made gradually.

I also suggest adding one item from Pat McKeough's (Publisher of the Successful Investor) standard recommendations: "Avoid stocks that are in the broker/media limelight." I agree. I have been following Pat since sometime in the nineties (my late father even before that), Pat's TSI Network publishes several very good publications.

Return to top of page.

Return to Financial Insight's main page.

![]()

![]()

First with the recent sudden drop in the Markets, my advice: Do Not Panic. We have seen this before and no doubt we will see it again. Markets often over react and those who over react with it usually pay the price. Obviously I do not know what the next week, month or even year will bring. This could be a blip, or something longer but history has shown that holding a diverse portfolio of high quality stocks and staying invested pays off in the long run. Also, I cannot stress enough, if anyone tries to tell you that they can advise you when to get in and out of the market, run away, and the more confident they sound the faster you should run.

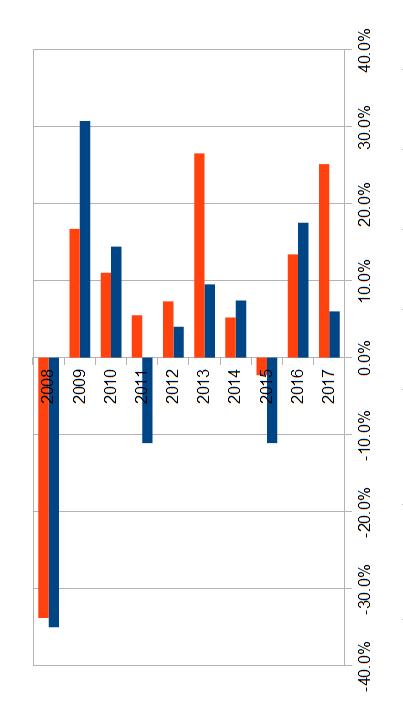

The chart on the right shows the percent that the DOW went up or down in red for the years 2008 to 2017 and the percent the TSX went up or down in blue for the same years. As you can see there were two down years for the DOW and three for the TSX, and in each case, down years were followed by up years. It is also worth noting that for 70% of the TSX (80% for the DOW) years the market went up which is in line with our past analysis of up versus down years. Put another way, you can try to second guess the market, but based on this you need to be right at least 70% of the time. Maybe you are better than I am, but I doubt I could second guess the market in the short term and be right over 70% of the time.

The chart on the right shows the percent that the DOW went up or down in red for the years 2008 to 2017 and the percent the TSX went up or down in blue for the same years. As you can see there were two down years for the DOW and three for the TSX, and in each case, down years were followed by up years. It is also worth noting that for 70% of the TSX (80% for the DOW) years the market went up which is in line with our past analysis of up versus down years. Put another way, you can try to second guess the market, but based on this you need to be right at least 70% of the time. Maybe you are better than I am, but I doubt I could second guess the market in the short term and be right over 70% of the time.

Also, it should be noted that while the DOW dropped about 9% since it peaked on January 27, 2018, it was up by about 25% for the year 2017 and this drop takes it back to late November values. So yes it was sudden and significant, and it could get worse, or not, before it gets better, but in retrospect, so far at least this is just a hiccup for the DOW. Although the Canadian case, that I suspect is currently just following it's southern neighbours lead, is somewhat worse as it's drop takes us back to November 2016 values. But in either case, trying to second guess the next move is a speculative gamble at best.

So, as always my advice remains the same, build a diversified portfolio of high quality stocks and stay invested while following our four IFC Investment Principles (shown below).

And again some of my past articles that are specifically relevant and worth reading or rereading include:

In October of 1995 I wrote Market Timing Can Improve Your Returns, But You Better Be Good. Here I demonstrate just how good you need to be to beat a buy and hold strategy. Better than you might think. For this one you will need to click the link to download a pdf copy of the original paper article.

In January of 2012 I wrote the rule that Trading is a Negative Sum Gain. Here I show how overall the majority of traders have to under perform the market. It is simple mathematics.

In 2012 I wrote Seeing Can Be Misleading. While I do like charts, I used one here, I show how easy it is to be misled by charts and give questions you should always ask.

On a slightly different note, with all the constant promotion of speciality investments etc. can I call your attentions to our January 2000 issue of Financial Insight? While it is fairly long, in it I review the previous 20 years (1980 - 2000). We posted it shortly before the technology bubble burst. In it I gave examples of how different very popular investments had blown up in investors hands. You might call it the Famous Last Words issue.

Finally, the proof is in the pudding, so to speak. Building and holding a diversified portfolio of high quality stocks has worked out pretty well for me. Here is a chart showing the value of $1,000 invested in my portfolio since January 1, 1998 compared to the markets.

The following are four basic principles that we believe to be the foundation of sound investing practice. By regularly referring to these principles we hope to avoid any major mistakes and ensure a satisfactory return on our long-term results. The four principles are:

1. Balance your investments according to your personal circumstances.

2. Always diversify your investments.

3. Invest in quality.

4. Invest regularly and gradually.

Return to top of page.

Return to Financial Insight's main page.

![]()

![]()

In January I wrote, "I cannot help but feel that we are nearing the point of maximum pessimism." My point being that people should resist the temptation, maybe even strong temptation to sell their stocks and/or look for a new approach. Well, the final numbers are not in yet, but unless something significant happens in the next 2 weeks, it looks like for 2016 the TSX will be up about 17% and the Dow will be up about 14%. Now while there is optimism, there are some who are suggesting that this pace cannot continue and they are contemplating getting out of the market. It never ends.

Yes it looks like 2016 will wind up being a good year, and while that does not ensure that 2017 will be a good year, neither does it suggest that it will not. Looking at relatively recent history: In 1999, following a year with a small loss of about 3%, the TSX rose almost 30%, then was followed by a more modest 6% in 2000. Granted there were more significant losses the next 2 years. But then in 2003 it rose about 24% followed by about 12% (2004) 22% (2005) 15% (2006), 7% (2007)then finally a loss of about 35% in 2008. But then it recovered in 2009 gaining about 31%, followed by about 14% (2010)before losing about 11% in 2011. The next 3 years were single digit gains to 2015 which loss about 11%. So this years gains follow last years loss. So what does that mean for 2017?

If my crystal Ball worked, I would tell you. Or maybe I would just keep it to myself and make a killing. As you can see, sometimes a good year is followed by another, sometimes it is not. Which leads me back to the same advice I gave at the beginning of the year.

"My advice remains the same as always, build a diversified portfolio of high quality stocks and stay invested."

Some of my past articles that are specifically relevant and worth reading or rereading include:

In October of 1995 I wrote Market Timing Can Improve Your Returns, But You Better Be Good. Here I demonstrate just how good you need to be to beat a buy and hold strategy. Better than you might think. For this one you will need to click the link to download a pdf copy of the original paper article.

In January of 2012 I wrote the rule that Trading is a Negative Sum Gain. Here I show how overall the majority of traders have to under perform the market. It is simple mathematics.

Finally, the proof is in the pudding so to speak. Building and holding a diversified portfolio of high quality stocks has worked out pretty well for me. Here is a chart showing the value of $1,000 invested in my portfolio since January 1, 1998 compared to the markets.

Return to top of page.

Return to Financial Insight's main page.

![]()

![]()

I cannot help but feel that we are nearing the point of maximum pessimism. Maybe it is just wishful thinking or maybe it is because we keep hearing rumblings about how buying and holding stocks is no longer the right approach or you need a new approach. Everything from you have to be an active trader, you have to get out of stocks until a better time, the large number of outfits pushing colored diamonds, TV personalities telling us to buy gold or silver and people pushing businesses that effectively run on subsidies (wind and solar). We have heard it all before and no doubt will hear it all again.

Late last year I had a conversation with a broker pushing colored diamonds or something like that. The thing is, the more he spoke the more I heard alarm bells about what he was selling, and I told him so. This only caused him to push harder which raised even more alarm bells.

I was recently reminded by my sister that I once told her that if I went away and ignored my portfolio for ten years, odds are that at the end of the period most of my decisions (doing nothing) would have been the right ones. She also noted hearing or reading another interesting comment, I am not sure from who but it was more or less to the effect that the people who lost the money in 2008 were those that sold. That sounds about right.

My advice remains the same as always, build a diversified portfolio of high quality stocks and stay invested. I will confess to not having written much in the last few years, however, over the last 20 or so years on this web site we have published over 60 Market Outlooks, almost 60 Articles, almost 60 Rules (Dave's Rules) and answered about 50 questions. They are all still available on this site and most are as applicable today as they were when we published them. So rather than reinvent the wheel I would like to call your attention to a half dozen articles that emphasize the risks of some of these specific approaches. So here goes:

First can I call your attentions to our January 2000 issue of Financial Insight? While it is fairly long, in it I review the previous 20 years (1980 - 2000). We posted it shortly before the technology bubble burst. In it I gave examples of how different very popular investments had blown up in investors hands. You might call it the Famous Last Words issue.

In October of 1995 I wrote Market Timing Can Improve Your Returns, But You Better Be Good. Here I demonstrate just how good you need to be to beat a buy and hold strategy. Better than you might think. For this one you will need to click the link to download a pdf copy of the original paper article.

In November of 2014 I wrote Computer Models: The Great Deception. There is no end to the number of Computer Models being used to try to beat the market. Here I explain the inherent weaknesses in these approaches.

In 2012 I wrote Seeing Can Be Misleading. While I do like charts, I show how easy it is to be misled by charts and give questions you should always ask.

In January of 2012 I wrote the rule that Trading is a Negative Sum Gain. Here I show how overall the majority of traders have to under perform the market. It is simple mathematics.

In March of 2000 I answered a question explaining why we should not have expected technology stocks to continue to soar. And by the way, they didn't.

Finally, the proof is in the pudding so to speak. Building and holding a diversified portfolio of high quality stocks has worked out pretty well for me. Here is a chart showing the value of $1,000 invested in my portfolio over 18 years ago compared to the markets.

On the more fun side, if you like to fish or have a corny sense of humor like I do, then you might enjoy my Dave's Rule from August 1995. But remember, that one was a fish story.

Return to top of page.

Return to Financial Insight's main page.

![]()

![]()

Where do we start? It has been a fascinating year. It ended very different from where it started. It started out looking a little shaky but overall we remained confident, by the end it seems that all you were hearing was doom and gloom. Is it really so bad? Is the world really coming to an end? Well, to quote my sister, "I wish the press would stop throwing gasoline on the fire." If I can add to that, I also wish the politician's would stop throwing gasoline on the fire. All this makes people believe that things are far worse than they really are, this not only worsens things, it leads to governments feeling the need to do something, even though they have a lot less control than they are prepared to admit and even though any action they take, will have a delayed impact of at least six months to a year. So in the end, these actions, many of which will be unnecessary, will in all likely hood be ineffective and in the long run there will be a price tag attached. Let's hope that the majority of the cost will be for infrastructure projects that need to be done anyway and once done will be over, avoiding the continuous structural costs of the past. On a positive note, if I can quote Marian, my wife, when she sent out our annual Christmas letter, "Given how the last few months of 2008 has turned out, 2009 may be a tough year, but we have been through this before when we had far less and we will come out of this again and in a few years have far more than we have today."

So where are we? We use to have a recession every few years; now we have not had one in nearly 20 years. If you had told me in 1990 that we would go nearly 20 years without a recession, I would have laughed at you. Yet here we are. It has often been said that market based capitalism is not a perfect system, but it is the best we have. I concur. It might be nice if we had a system where we all got the same rewards and we would all work hard for the benefit of the world. Yes that would be nice, but we are not ants, and we are not wired that way. Yes most of us believe in doing the right thing, have a high moral character (although our individual definitions of morality may vary) but we are wired to first look out for the interest and well being of ourselves and our families, then those close to us, then those of the same religion, then our country and somewhere down the line maybe the benefit everyone on the planet. For everyone the list and order will be little different, but you get the point. If you do not believe me, ask yourself: Would you sacrifice the five people most important to you to save a hundred strangers who live on the other side of the planet? How about a thousand?

Market based Capitalism has brought the world many innovations. However, it is not perfect and it does need a certain level of checks and balances. The markets greatest weakness is that in the short run it is driven by greed and fear. On the other hand one of its greatest strengths may be that it is driven by greed and fear. As a result, every so often a correction or recession becomes necessary to shake out inefficiencies, realign things and to bring us back to reality.

So what happened? Well, aside from being overdue, a number of things. However, it appears that the most significant was a financial crises brought about by a thing called sub-prime mortgages. As I understand it, it went sort of like this. The economy was doing very well. Governments (especially the U.S. government) believed it would be nice if more people could own their own homes. Their hearts were in the right place. Since interest rates were low and house prices were climbing, at the time it seemed like a good idea to let people borrow 100% of the value of their home (nothing down) and then only require them to make interest payments. Since values were rising, people would accrue equity through the inflated house values. And inflate they did as people who could not really afford to buy their own home entered (maybe flooded) certain markets. Of course this also had to be financed. Some of this came from traditional sources, but then clever financiers decided to package the loans into investment vehicles and sell them as sound mortgage backed securities. Of course most of the investors did not really know or understand what they were investing in and it did not help when rating agencies gave the vehicles high ratings. This might not have worked so well had there not been a lot of investors reaching for yield, something we have discouraged. In our opinion, reaching for yield, or looking for higher and higher returns from fixed income securities has become a problem since the days of high inflation and high interest rates. Investors remember when they could get 10% plus interest on secure investments like government bonds and GIC's etc. They have this misguided idea that they should still be able to get these high rates without risk and go looking for them. Brokers and advisors who want to please their clients then promoted vehicles that we considered inappropriate like junk bonds, income trusts, sub-prime mortgages and hedge funds to name a few, without due regard for risk. Everything was good until the inevitable hick- up and then the whole thing unraveled. Few saw it coming. While we always thought that things like income trusts and hedge funds were ill-conceived, inappropriate for most investors and would burn their investors, we never saw this coming.

So what happens next? Well only time will tell. I recently called the bottom, but as I like to say, it is only about the fourth time I called the bottom, and eventually I will be right. Personally I think that we have seen the market bottom and that sometime in late 2009 the economy will turn too. But it could take longer. The road back might only take a year or so, but it could take a few, but I am confident in the long term future. Globalization, technology, the internet and automation are wonderful things that should ultimately benefit people around the world and in time bring us all closer together. But the road is bound to be a bumpy one. If you strip away the money and financial terms etc. what you have left is a finite amount of resources. By resources I mean work force, infrastructure, buildings, plants and natural resources etc. This is not a physical disaster like the flood's of New Orleans's where physical assets/resources were destroyed. It is an economic recession and it does not change the amount of resources available. What it will do is change how those resources are owned and how and where they are deployed. In the end, that will probably mean that they are used more effectively, resulting in a stronger economy, a better standard of living for more people and hopefully a greener economy as the shakeup will provide opportunities for change.

So what is an investor to do? We believe that our principles are more important than ever. Panicking will only cost you. Hopefully you have a diversified portfolio of high quality stocks. Both quality and diversity are very critical at this juncture. A friend asked me the other day what sectors he should emphasize now. I pointed out that there are more ways to be wrong then right and I believe that being diversified is extremely important, especially right now. More importantly, you need to be sure not to be overexposed in any sector or company. Second, I cannot stress quality enough. Most of the best companies, many of which remain profitable will benefit from the shakeup and eventually flourish. Many of the lower quality ones will disappear. On closing, be patient and remember Marian's words "we have been through this before when we had far less and we will come out of this again and in a few years have far more than we have today."

Return to top of page.

Return to Financial Insight's main page.

![]()

![]()

IFC: Since we spoke a year ago a lot has happened. At the time you spoke of your returns and indicated that while you might lose money in the bad times, you tend to outperform the market during the bad times. So how do your returns look now and would you change your approach?

Heinze: I definitely would not change my approach. It is because of times like these that I stick to my approach. To follow up from last year, for the year 2008 my personal portfolio lost 28%. I believe that was my worst year ever. But that still beats the market and most Canadian Equity mutual funds. Also, to put it in perspective it was equal to giving up the last 3 to four years returns. That may sound bad, but after 30 years of investing it is not really a big deal and it is bound to happen from time to time.

IFC: So that is like giving up some previous gains. Do you wonder if you should have sold high and avoided the loss?

Heinze: If my crystal ball worked, I would be much wealthier than I am now, but it does not. Yes I gave up some gains, but if I got out of the market every time there might be a setback, I would never be in the market and I would not have any gains to give up so I would be a lot poorer today. Reality is that it is three steps forward, one back, two forward, one back, five forward three back kind of thing. But at the end of the day, or decade, my approach provides good returns with minimal losses.

IFC: Last time you compared you returns to Canadian Equity mutual funds. How do you measure up now?

Heinze: I am happy with my relative performance. Of course while I know my numbers, comparative information as at December 31 is not yet available. As of December 31, for the year 2008 my portfolio lost 28%, for the ten years ended December 31, 2008 I had an average annual return of 6.4%. However, we can compare the period ended November 30, 2008. For the 12 months ended November 30, 2008, I lost 26.8%. For the 10 years ended November 30, 2008, I had an average annual return of 6.8%. Based on Globe Investor Gold funds reports, that puts me in the top 22% for one year returns and top 20% for 10 year returns for Canadian Equity funds, which is the best comparison I have. I also want to point out, as I did last year, that is of the funds that survived, as not all the funds in existence at the beginning of the period were still around at the end.

IFC: You talked about funds that disappear last year so we will not rehash it today. If readers wish more on that they can scroll down to that conversation which is reprinted below. In light of the economic times, perhaps we can talk about some economic issues. First, have you ever seen anything like this before?

Heinze: This actually reminds me a lot of 1982. When I look at a log chart of the TSX going back into the seventies, I see striking similarities. The drop is similar to the one that happened in 1982. At around 9000 the percentage drop was almost identical, so we have dropped a little more from top to bottom, assuming we have seen the bottom, but really it is a very similar chart. I lived in Calgary in 1982 and the current housing market in parts of the United States really reminds me of that time in Calgary. I think this is very similar to 1982 and the market recovered and thrived after that. It worked out very well for us, in 1984 we bought our first house and as luck would have it we could not have planned it better. I talked about that in the January 2000 issue of Financial Insight that is reprinted on our web site.

IFC: Are there differences?

Heinze: Yes there are some positive differences. In 1982 we were facing runaway inflation and runaway interest rates. Today, interest rates and inflation are both under control. Also, it appears that most of the economic powers are working together. If they continue and resist the urge for protectionism, then we may be about to witness something unprecedented, global cooperation. The other difference is in the approach of government, or at least in the Canadian government. In 1982, the Liberal government tried to spend its way out of the recession, something we could not afford, especially given the runaway inflation and interest rates of the time. This created huge structural deficits that took years and two different governments to bring under control. Today, inflation and interest rates are under control and we have a healthy fear of deficits.

IFC: Do you oppose Government stimulus at this point?

Heinze: I am concerned. One of the most dangerous things an investor can say is "this time it is different." But there are differences. Inflation and interest rates are under control and there is a very real understanding of how dangerous deficits can be and what they will cost. But yes, I am concerned. However, there is a lot of infrastructure that needs tending to and sooner or later we will have to pay for it. It seems to me that this is the time to do it, while costs are lower and labor is more available. We get the job done, cheaper, get some stimulus and wind up with a better infrastructure that helps position us for recovery. As long as we only do what needs to be or should be done and do not do projects for the sake of doing projects and once they are done we stop.

IFC: How do you feel about corporate bail outs?

Heinze: Fundamentally I oppose them. It has been said that subsidy and government bailout are the Canadian way. I refer to this as pulling everyone down to the lowest common denominator. It is far better to create an environment that encourages competition and rewards success which in the long run will create more jobs and opportunity and pull everyone up to the highest common denominator. That is the Canada that I would like to see and I like to believe it is achievable. Having said that, I am more sympathetic than I normally would be. The financial crises created a situation that no one could have reasonably been expected to be prepared for. However, I am worried that in the long run, we may do more harm than good. Probably the best thing governments can do is to try to grease the wheels of the financial system the best they can and get things going again, this will create an environment for success.

IFC: What about the auto sector?

Heinze: The same holds true for them. It may be necessary to give a temporary life line but in the end the best thing that can be done for them is to get the economy and the money flowing again. At the end of the day, there will be an auto sector, as people will still be buying cars. However, I expect that the sector will be very different then it is today and I hope that by throwing them a life line we are not just deferring the inevitable.

IFC: Well it looks as though 2009 will be a very interesting year. I look forward to seeing what happens. Thank you.

Heinze: I look forward to it too, and you are welcome.

Editors Note: Here is an updated chart in pdf format of the respective performance of $1,000 invested in Dave's portfolio verse the TSX and the DOW from January 1, 1998 to the end of January 2011.

Return to top of page.

Return to Financial Insight's main page.

![]()

![]()

FI: Tell us about your investment performance.

Heinze: Probably the most relevant is the performance on my own portfolio, as it resembles a Canadian Equity mutual fund. For the 9 years ended December 31, 2006, my portfolio had an average annual return of 11.5%. This beat the TSX composite and the Dow Jones Industrial Index's that had average annual returns of about 9.3% and 7.0% respectively. Here is a chart in pdf format of the respective performance of $1,000 invested in all three to the end of September 2007.

I only have records that can be used to get these numbers for the last nine years. However, from the information I have, chances are my ten year return would be slightly better than my 9 year performance at the end of 2006. Based on GlobeinvestorGold information, compared to the funds that survived the last ten years, 11.5% per year average return would be in the top 7% of all mutual funds in Canada and the top 13% of Canadian Equity funds. If I deduct 1.5% for management fees, my return puts me in the top 14% of all funds and the top 35% of Canadian Equity funds.

Editors note: January 23, 2008: For the ten years ended December 31, 2007, Dave's portfolio returned 11.07%. Based on the GlobeinvestorGold information, this put him in the 10% of all funds and top 15% of Canadian Equity funds.

FI: What do you mean by funds that survived?

Heinze: Well a lot of funds have disappeared over the last 10 years. I cannot seem to find good information on how many funds disappeared, however, it appears that in Canada there were around 2,000 funds over ten years ago. As of December 31, 2006, there are over 6,000 funds listed on GlobeinvestorGold, of those only 1060 funds were over 10 years old. For Canadian equity funds, there were 617 funds listed, yet only 104 were over 10 years old. It is evident that a lot of funds that existed 10 years ago, perhaps even the majority did not survive, and those funds are not included in any comparisons.

FI: So what happened to the ones that disappeared?

Heinze: Good question. I suspect that while some dissolved, the vast majority were merged with other funds. But lets be fair, very few, if any of the new merged funds would have taken on the name and record of the poorer performer. So the question is, if you bought a fund 10 years ago and held on to it through whatever mergers etc., what is the chance that you would have realized a return as good as the top 50%. You might assume that there would be a 50% chance that you would hold a fund with a 10 year track record in the top 50%, but I suspect that the odds are more like 25% that you would have realized that return on your fund.

FI: What about your shorter term performance?

Heinze: Well that depends on the period. I had a very good year in 2006 with a return of 19.0%, and I beat the TSX that year. But this year while I should make money, I expect that my return will be a little less that the TSX, mainly due to currency losses. All portfolio managers have good years and bad years, I am no different. If you meet one that thinks they will not have bad years, or bad years relative to the indexes, run away.

As a general rule, I do well during the good times, but not exceptionally well, I do better than average in the average times and very well relatively in the bad times. I must stress the word relatively. In other words, I may still lose money in a down market, but I usually do a fair bit better than the indexes during those times. I am happy with that mix as it is reasonable and should be fairly sustainable.

FI: You mentioned Currency Losses this year?

Heinze: Yes, the Canadian dollar had an exceptional year. This can be and is both a blessing and a curse, but that is a whole other discussion. In terms of portfolio performance, like any portfolio holding U.S. stocks, while the U.S. stocks might have made money or stood still in U.S. dollars, they may have lost ground in Canadian dollars. Of course, the TSX is all Canadian, so it would not be affected by this.

FI: Okay, so back to your performance. You seem to have pretty sound returns, is there a secret to your success?

Heinze: No secret, no magic, no great insights. I do not know the future. Well maybe that is the secret; I know I do not know the future and that I will make mistakes. I also do not expect to make a lot of money fast. That could be an advantage.

What I can do is build a well diversified portfolio of high quality stocks that I intend to hold for years, maybe decades. You see, I do know how to pick a good high quality company with a good earnings history and good potential, and, I can be right about that most of the time. Not all the time, but most of the time. I can also calculate a reasonable intrinsic value for a stock. This will not help me time the market, but will help me satisfy myself that I am holding good value overall. Finally, I can build a good well diversified portfolio of these stocks. The rest should be no more then tinkering. My approach is not a secret, but you could say it is a sound formula.

FI: Where do you get your ideas about companies to pick?

Heinze: A great person once said that everyone needs a hand from time to time. Or maybe I said it, but I am sure I was not the first. There are many publications readily available; the trick is to find the good ones. Obviously I believe those are the ones that think like I do. I will not say they are the best, but two major sources that I follow are The Investment Reporter, put out by MPL communications and Pat McKeough's The Successful Investor. Actually, I get all of McKeough's publications, and he is my favourite. Both of these publications have followed a similar philosophy for years. The Investment Reporter has been around since the forties. McKeough used to write for them, I believe in the eighties.

These publications give me sound ideas, help me stay abreast of current affairs regarding my companies without overreacting, and in general give sound investing advise. Then I do my own analysis and make decisions that I believe are most suited to the circumstances. It is worth noting that I do not always agree with these publications, hell, I do not always agree with anyone, not even my wife. For that matter, I may not even agree with myself sometimes. Also, just like me, these publications are not always right. But, their information and recommendations are generally sound and their philosophy is very similar to mine. Or maybe my philosophy is similar to theirs, who knows.

FI: Are there other references you use?

Heinze: Obviously there are the financial statements of the companies. Also, there are lots of places (including broker research) where I can get information. In those cases I pay attention to things like the financial statements, historical numbers and general information, but put little reliance on the opinions.

FI: Why is that? I would have thought that the opinions are the important part?

Heinze: Well, as a general rule I do not feel they are that reliable. This can be for a number of reasons; like being too close to the action, over reacting, the all to human inclination of trying to outsmart the future, fear of being wrong, inflated egos, short term emphasis, and even conflicts of interest. I am sure that this does not apply to many sources; the trick is to find the ones you can trust. So I use these mainly for the factual information, mainly the numbers and sometimes the news.

FI: What is your thought on investing in trends?

Heinze: Have fun and count me out. Personally, until I get my crystal ball working, I will ignore trends. If anything I would invest against the trend, but that is probably my contrarian nature poking through. Or maybe I am just negative.

FI: Are you generally negative?

Heinze: I do not think so. My mother used to say that I was the last of the great optimise. I think that was and is true. I am a glass half full kind of guy. I would not be where I am today if that was not true.

FI: How does that effect investing?

Heinze: I think it has served me well. I build a well diversified portfolio of high quality companies with good prospects that I can hold for a long time. And I do hold most of them for many years, sometimes decades. Most years I only turn over about ten percent of my portfolios. You have to be an optimist to do that, especially during turmoil and negative events. There is almost always some reason to panic, but these events, even the worst of them like Black Monday and 911 for example, nearly always turn out to be blips from an overall long term economic point of view.

FI: Is that Optimism or steady nerves?

Heinze: Probably both. You have to be able to sit through the inevitable bad times and to some extent use them as opportunities when you can. That takes steady nerves, but if you are not optimistic, then I do not see how you can do that.

FI: So to sum it up, you're an optimist whose approach is to build a good portfolio of high quality companies that you can hold for many years, or even decades. It is that simple.

Heinze: Yes it is really fairly simple. If I were to add anything else, it might be to avoid the popular and fancy investments, especially ones with special bells and whistles. In the end holding hot or fancy stuff, flipping investments or regularly changing approaches will probably kill you, investment wise. But you might make your broker rich.

FI: Thank you.

Heinze: You're welcome.

Return to top of page.

Return to Financial Insight's main page.

![]()

![]()

In the year 2003 the TSX grew 24% and the DOW grew 25%. By any measure that was a truly outstanding year but not totally unexpected given the three previous dismal years. Yet there are still large numbers of people sitting on the sidelines waiting for a solid recovery before they start investing. That speaks well for the future. Markets climb a so-called wall of worry. Then overconfidence sets in and the inevitable setback occurs. Then, just as the point of optimum pessimism sets in they turn upward. If we could determine when these points of maximum confidence and peak pessimism were we would have it made. However, reality is that we cannot. Given that qualification, and any significant unforeseen events, we believe that 2004 will be a good year for investors, not necessarily as good as last year, but good nonetheless.

Last year was the first good year following the longest and deepest market setback since the forties, so the upward trend is likely to last a while. Also, we believe that there is still a lot of pessimism and as a result, a lot of money on the sideline waiting to come into the market. While there are concerns about the low U.S. dollar, it will make U.S. companies more competitive and since the U.S. is the biggest economic driver in the world, this energy will filter down. Next, there are economic drivers like the maturing baby boomers who are coming into the most affluent years of their life cycle, efficiency is continually increasing, globalization is ultimately good for everyone, and recent tax cuts are still a positive factor. Finally, this is the year of the U.S. Presidential election, so there is a lot of incentive for those in power to ensure that overall the news is good. So baring any significant unforeseen events, we believe that 2004 will be a good year for the markets, but our advice remains the same.

If you have been following our IFC principles, odds are that you held up reasonably well through the set backs and did well last year. Regardless, these principles still stand. They will help you to weather the bad times and profit from the good, and since predictions are usually the weakest part of investing, we urge you to stand by solid principles regardless of any predictions, no matter how sure you are of them.

Return to top of page.

Return to Financial Insight's main page.

![]()

![]()

Well things seem to be shaping up quite nicely. Both the Dow and the TSX are up over 25% from their lows set back in October. While nothing is for sure, it is likely we have seen the bottom and that things are looking better now. Hopefully you have continued to follow our advice of holding quality and staying invested, otherwise you may have missed on the first pop of the recovery. Regardless, our advice remains the same. Build a diversified portfolio of high quality stocks and above all, stay invested. If that is what you have been doing, stay the course, you can use the inevitable dips to top up and the peaks to do a little trimming, but stay the course. If you have been out of the market, we warn against waiting for another dip or until you are sure that we are in a bull. The market could easily rise 20% before the next 10% pull back, and once you are sure we are in a bull, it may be about to end. So those approaches could be costly. At the same time, we do not suggest jumping in all at once.

If you have stayed out, then start a regular investing program that will bring you to your objective investment mix over a period of time, perhaps two years. Then maintain the mix. While in theory it is likely that you would be better off to jump right in now, it is usually wiser to invest gradually over time. Markets never travel in a straight line, so investing gradually will allow you to take advantage of the regular setbacks that we will go through. Further, and perhaps more importantly, unexpected events do happen and can result in serious setbacks. Investing gradually will ensure that you do not do all your investing at a peak just before a significant pull back, which could be devastating, at least psychologically if not financially.

So we believe that we are through the worst and that the markets are headed higher over the next few years. However, even if we are right, we are certain that the ride will be a bumpy one and that somewhere over the horizon are some serious drawbacks followed by some more bull markets. And that is how the markets manage to grow at an average rate of around 10% per year over the long haul.

Return to top of page.

Return to Financial Insight's main page.

![]()

![]()

Have you had enough yet? Well we sure have, but while we believe the end of the bear is near, we are not expecting anything to happen fast. It is our suspicion that we are in the final testing phase of the bear market. To be honest, we expected a quick dip at the end of 2002 followed by a long but volatile upward journey. Well, the year 2002 ended stronger than we thought it might and 2003 is unfolding slower than we had hoped. Chances are that world events over the next while will be a major factor. A quick decisive war in Iraq could put all this behind us. However, if things remain uncertain, than nothing is likely to happen fast. These are truly interesting (if not disconcerting) times.

Eventually the economy will improve and corporate profits will rebound. This will result in higher share prices as ultimately a company's long-term profitability is reflected in its price. In the short term, anything can happen. However, in the long term, on the whole, the best companies will prosper and so will their owners. The thing is, it can take a lot of patience to get there.

We believe that those with patience who stick with our IFC investment principles will eventually be rewarded and glad that they did. Many of those who do not follow (and stick to) a similar philosophy, or who allow themselves to be scared out of their best stocks, will ultimately be dissatisfied with their investment experience as they will probably have managed to buy high and sell low.

Return to top of page.

Return to Financial Insight's main page.

![]()

![]()

The market is low and it will eventually recover and move on to new highs, most likely climbing a wall of worry. It will probably be an uphill battle with trials, tribulations and setbacks along the way. In fact, years from now when we study the charts of the 1990's and the first decade of the twenty-first century, this bear will resemble a setback, maybe a major setback, but a setback in a much larger bull market. This leads us back to our standing advice that we believe is especially important right now.

First and foremost, balance your portfolio according to your personal circumstances. Ignore the market or timing as in the long run they will probably cause you to buy high and sell low. So decide what your mix should be and stick to it. Remember, at times like this when markets are low, it is a result of people being more interested in selling than buying, and when the market is low they should be buying not selling. It is fair to say that it takes a lot of courage to buy low, which explains why the majority are often wrong.

Stick with quality companies. While we believe that a recovery is imminent, many of the lower quality companies will be left behind to either fail or survive but never amount to much. Regardless of where the market goes, a portfolio of speculations is just that, a portfolio of speculations that might come true but most likely will wither away.

Diversify, diversify, diversify. We will say it again for good measure, diversify. It is highly unlikely that all sectors or geographic regions will recover together. Different sectors will recover at different rates and times. If you stay diversified, chances are you will always hold some stocks in the right area. We have seen this in the last couple of years. While the markets have dropped approximately forty percent from peak to bottom, some sectors and some companies have gained and some have dropped a lot more than forty percent. There is no telling which ones will move first, but rest assured, the more certain we are that we know what will move next, the more certain we are that we are wrong. On the same thought, we must warn you about being overweighted in technology stocks. While it is prudent to have some holdings in this area, we are concerned about the general preoccupation with when technology will recover. This is only a small part of the market and should be reflected as such in your portfolio. Further, even if the market recovers, technology might not recover with it. Our suspicion is that a technology recovery could be years away and that it may not include many of the companies that currently make up that sector.

Finally, there is our final principle, to invest regularly and gradually. A disciplined investment program will help you to build a sound portfolio over time, taking advantage of opportunities and limiting the damage caused by the inedible market peaks.

Return to top of page.

Return to Financial Insight's main page.

![]()

![]()

They say it is darkest before the dawn. In the markets this and the opposite scenario are often true. Let us start with bull markets. They will often build to unrealistic heights ignoring all the danger signs. This is what happened a couple of years ago, especially in the case of technology stocks. People just could not wait to buy them. There were a few of us continuing to warn against some of the investments that just bared no logic whatsoever. Then in our first issue of 2000, just before the beginning of the collapse, we discussed many of the similarities to other past collapses. That issue can still be viewed by taking this link to the January 2000 issue of Financial Insight.

What often happens is that the market gets hotter and hotter with all facts, warning signs and reason being ignored. Then when the most pessimistic bears decide they cannot stand being left out any longer and jump aboard, reason suddenly prevails. Usually as a result of some major event or series of events, which cause the markets to start to slide. This can happen quickly or gradually. Eventually people start bailing and selling. Then over time the attitude becomes so pessimistic that no matter how good the news, the markets read it all as bad. Sound Familiar.

We believe that we are at the point where the markets are irrationally pessimistic, which makes for a good buying and/or holding opportunity. It is at this stage where markets bottom out and eventually change direction. It can happen quickly or slowly. In this case we expect a slow reversal of the trend and it may be very subtle. Then one day in about a year, we will suddenly realize that the turnaround has happened and that the recovery is well under way. Then over the next few years we can go into the next round and do it all over again. What is an investor to do?

Again, nothing changes. Build a well-diversified portfolio of high quality stocks, balanced with safe securities (high quality bonds, GIC's T-Bills etc.) in such a way as to suit your personal circumstances. The balance should suit you, not the market nor your financial advisor. Quality is as important as ever, as crap is still crap. Sound companies with a good earnings history, good prospects and good management will weather the storms and prosper in the good times. Poor ones will usually fail, not necessarily immediately, but eventually. Finally there is the diversity issue. Different sectors, different regions and for that matter different companies tend to prosper at different times, and the timing has a funny way of surprising us, so diversify.

Return to top of page.

Return to Financial Insight's main page.

![]()

![]()

You might say this is a stock pickers market. Some stocks seem to be taking off while others are just getting beaten up. On the whole we have seen some overall strength. At the same time, this strength is coupled with extreme volatility making it hard to get a fix on where things are going. Our expectation is that this will continue for some time and in a year or two most prices will be higher than they are now. Of course, as we have seen in the past, that year or two could easily wind up being stretched into a much longer time period.

Over the long run, which is what counts, there is a lot of reason for optimism. Increased globalization, maturing baby boomers, improved efficiencies and decreased tax rates will drive the economy on to bigger and better things. Where we are going is not the major question, it is more a matter of at what speed and the route that we will take, and the route is bound to be choppy. So what is the best strategy?

Overall, we recommend that you stick to our four IFC investments principles as in the long run we expect they will serve you well. On a more micro base, we have been using this strength as an opportunity to dump some of the stocks we no longer like or are not as fond of. This is also freeing up some cash for future opportunities and providing cash to pick up or increase our holdings in a few stocks that we do like but have been showing some weakness. However, this is only tinkering as our core portfolios are remaining in tact, and this tinkering is after all something we do anyway as opportunities present themselves.

Return to top of page.

Return to Financial Insight's main page.

![]()

![]()

The first year of the new millennium will not be easily forgotten. For many of us it was year with some great changes but will unfortunately be remembered as a year of personal (non-financial) loss. While this was true for us, based on the Christmas letters that we received from family and friends, it seems that this was true for many others as well. On a global scale, it was the year the world changed, or maybe more accurately, the year the world awakened to the seriousness of international terrorism. On the positive side, it may be remembered, and we hope it is remembered as a major positive turning point in global co-operation and unity. On the financial side, it was the second year in a row where the Dow declined about 6 percent and a year where the TSE 300 declined about 14 percent, although some of us did managed to end on the upside. This leaves us with the question; how did the year 2001 measure up historically?

In our May & June 2001 issue, we posted some charts of the last couple decades and noted that for the most part we were in the middle of an upward sloped trading channel. We indicated that in our opinion, in 2001, the Dow Jones Industrial average could drop as low as 8,000 without breaking out of the channel. It is interesting to note that the Dow bottomed out in 2001 at 7927. We have redrawn the chart, again using Big Charts (see link in the Interesting Links section below) and note that the Dow has now climbed up to just the below the middle of the channel. We also noted that for the Toronto Stock Exchange, based on the last decade (the information available using Big Charts) that depending on how you draw the line, the channel might have been broken a couple of times, but in the end, prices returned to the channel. We also noted that from late 1999 to mid 2000 a bearish head and shoulders formation was created, which suggested that the TSE 300 could drop to the mid 6000 range, but even that would not break the channel. It is interesting to note that the TSE 300 bottomed out at 6513 in 2001. We have since redrawn the chart and find it interesting to note that the way we drew the lines suggest that the TSE did briefly fall slightly below the support line but that it closed the year in the bottom quarter of the channel. So, where do we go from here?

We believe that the charts support our position that nothing has changed. From a market and economic perspective, nothing unusual has happened. Both are growing, but there will always be ups and downs along the way, and some of them will come as complete surprises, while others will sneak up on you and by the time you recognize them, it will be too late. Overall, ten years from now, the last couple of years will blend into the charts and appear as just another blip along the way. In the short run, we believe that we are experiencing another one of those buying opportunities that keep cropping up, however, remember, "It is really a market of stocks, not a stock market." Many companies will flourish, and in the long run, most of the quality ones will, while many of those of lesser quality will eventually disappoint you. Also, even with the good companies, the road will not be a smooth or totally predictable one. So our advice stands. Stick to our four IFC Investment principles. As hard as it may sometimes be to do that, we are confident that in the long run you will be glad you did. We know we have been.

Return to top of page.

Return to Financial Insight's main page.

![]()

![]()

What a month September was. We believed that we were going through a bottoming out process, then like everyone else, on Tuesday September 11, we woke up in disbelief about what had happened. Once we absorbed what happened, we expected that when the markets opened, they would drop about 10 percent more in a panic sell off, as some investors would have to get out of the market. So far, that is pretty close to what happened. Now we expect that things will be extremely volatile for some time with the new market lows being tested at least once and maybe a few times. However, for the most part, the underlining factors that are powering the economy are still intact.

The baby boomers are in their peak earning years, are eliminating their debts, saving and spending. Many governments have eliminated their deficits and are starting to pay off their debts. We are in, and likely to stay in for some time, a low inflation, lower tax and low interest rate environment. Finally, we are moving into a very global market that has and will continue to improve the standard of living for people all over the world.

Many feared that after September 11, the world borders would be closing. We doubted that all along, and we believe that the early indications point to an increased commitment to open markets, especially within North America. For a short time, cross border activity will be slowed, however, we expect to see increased trade, with tighter security in the long run. The simple fact is that we (all nations) need each other, can help each other and in the long run will improve each other's standard of living; a fact that does not seem to be lost on most of the world's leaders. As for Canada, while we would prefer this were not the case, in the Eastern United States, one way or another, there will be some massive construction projects going on for some time. These projects are bound to require a lot of Canadian resources, including technical, personnel and physical.

Simply put, Canada is an important part of the solution, not part of the problem, and the powers to be in both Canada and the United States recognize this. Will the recent events have an enormous cost to society? Of course they will. This was truly a disaster. Should we all feel greatly grieved by the events? Yes, and we are. However, we will get past this and move on to better things. There is also an opportunity here. We are seeing a degree of global unity, co-operation and support that is unlike anything we have ever seen. While it is unlikely that we can stamp out bigotry and hatred, and to some extent recent events will fuel them. There is a genuine opportunity to significantly reduce them and promote human unity, cooperation, support and trade.

So what is an investor to do? First and foremost, do not panic. You are bound to be holding some investments that will be genuinely hurt by recent events. However, the damage is done and chances are that the market has over-reacted, so sit tight. If you are holding a balanced and diversified portfolio of high quality investments, then you should weather the next while with limited short-term damage, and little or no permanent damage. If you have excess cash to invest, we believe that over the next while we will experience an exceptional buying opportunity. Just be sure to stick to our IFC investment principles and put a little extra emphasis on quality.

Return to top of page.

Return to Financial Insight's main page.

![]()

![]()

It is hard to wake a sleeping bear, much less turn it into a raging bull. It was not that long ago that we were saying that there was no slowing this raging bull, but that sooner or later there was bound to be a correction. More recently, we found ourselves warning about being overweight in hot technology stocks. At the time it seemed that everyone was into them and convinced that there were fortunes to be made in technology and the Internet. All you needed was a story, no need to worry about troublesome things like profits. It seemed that we were continually warning that this approach would end in disaster. However, the masses knew better and we were out of touch. Then along came the year 2000, slow talking, smooth walking (or something like that) 2000, and the millennium ended with headlines like Tech Wreak 2000. Now what concerns us that there are two new distinct groups, those that are swearing off stocks (AGAIN?) and those that are waiting for the next technology rally.

In the long run, both of these are attitudes that will rob you of good returns. Those who are swearing off stocks will be selling when they should be buying or holding, which will rob them of the sound long term returns that a good stock portfolio should provide. But it gets worse, many of them will repeat the cycle by not being able to resist and jumping in again at the next peak. Those who are waiting for the next tech wave are also making an error. There may be many other sectors that come and go before the technology stocks have their turn. Not to mention that this approach might keep them on the sidelines until the next peak. Also, the biggest benefactors of technology are usually those who use the technology, not those who produce it. After all, if no one benefits from it, then it must be worthless. Right? And then there is that pesky thing called profits. Like it or not, that is what companies are in business for, and in the end, despite short term fluctuations, that is what will drive stock prices. So here we go again.

Funny how our market discussions continually lead us back to our four IFC Investment Principles. Soon, this bear market will wake up and turn into a bull. Soon might not be for a couple of years, however, we think that by the end of the year the markets will be higher than they are now and that by next summer, the bull will be raging again. We also want to remind you that on average, sound long-term returns of 8 to 12 percent are what a reasonable investors with a well-balanced portfolio of high quality stocks can expect. So you can chase rainbows if you like, but we believe that if you stick to our four IFC Investment Principles and keep your expectations reasonable, in the end you will be a successful investor.

Return to top of page.

Return to Financial Insight's main page.

![]()

![]()

We believe that we have seen the worst of the recent set backs and that the market is presenting us with a buying opportunity. Possibly one last opportunity before the bull takes over again. We think that by the end of the year the economy will be growing again and that the economic expansion of recent years will be back on track. Having said that, we must change our position on the actions of the U.S. Federal Reserve. As recently as March, we were calling for cuts in interest rates and expressing a concern that the Fed might be moving to slowly, as it takes in excess of six months for interest rate moves to filter through the economy and have an impact. We still believe that they were overzealous in raising rates last year, and slow to change direction after the damage had been done. However, we suspect that with the actions taken so far, plus other factors, six to twelve months from now the economy will be moving right along. If we are right, and interest rates are cut further over the next few months, then the economy may become over stimulated in 2002 and tightening will become necessary to slow the economy. Therefore, while it is important for Federal monetary managers to react by adjusting interest rates, since the impact of their actions takes so long to filter through the economy, it is equally important that they do not overreact.

As for the market perspective, we have indulged ourselves in some technical analysis of the markets and found some interesting results.

Note: The next few paragraphs refer to some charts that we have created using Big Charts. To view these charts in a separate window, right click this link, then select "Open in New Window." A link has also been provided to Big Charts web site, in the Interesting Web Sites section of this letter.

First, using Big Charts we created a chart of the Dow Jones Industrial Average since about 1970. You will note that we drew a long-term line of resistance and support on the chart. Resistance is a point where prices cannot seem to go any higher while support is a point where prices seem to stop going down. These two lines form a trading channel that has been maintained since about 1978. As you can see, we are currently in the middle of the range of the channel and the Dow could drop as low as 8,000 without breaking out of it. So, while we seem to be going though a significant correction, the chart shows this to be a fairly mild correction after a significant expansion. As a matter of interest, the slope of this channel represents an average growth rate of approximately 13% per year. Historically, this is an exceptional return.

Next, using Big Charts we charted the TSE 300 from 1992 to current. We could not go as far back as Big Charts only provided information back to mid 1991. Here again, you can see a trading channel that started around 1992. Depending on how you draw the line, the channel might have been temporarily broken a couple of times, but in the end, prices returned to the channel. We also noticed that from late 1999 to mid 2000, a head and shoulders formation was created. This is a bearish formation that in this case suggests that the TSE 300 could drop to the mid 6,000 range. So far it has dropped to about 7,400. However, even a drop to 6,500 would not necessarily break the channel. Therefore, while the market has been seeing some wild gyrations lately, as you can see, it has not broken its general upward trend and is not showing any signs that it is likely to either. As a matter of interest, the slop of this channel represents an average growth rate of approximately 12% per year. Again, an exceptional return from a historical perspective.

The final chart prepared using Big Charts, shows the Nasdaq Composite from 1974 to present. It shows a very definite trading range from early 1975 to present. Except that in 1990 it temporarily dropped below the support line then in 1999 it significantly broke the resistance line. However, as can be seen by the chart, neither breakout was sustained. Now the Nasdaq is back in the same trading channel that it has been in for about 26 years. The Nasdaq could fall as low as 1,500 without breaking out of this channel. As a matter of interest, the slope of this channel represents an average growth rate of approximately 13% per year. Again, historically, this is an exceptional return.

So as you can see, we seem to be in a very healthy long-term trading channel. Yes there are severe gyrations and rotations in and out of sectors. While the timing of these is near impossible to predict, the overall long term result seems to be very steady. So once again, we must continue to stress our four IFC Investment Principles. If you stick to these principles and avoid trying to pick the next hot sector, stock or short-term trend, we believe you will do very well in the long run.

Return to top of page.

Return to Financial Insight's main page.

![]()

![]()

For the longest time it seemed that nothing could stop the market. There would be dips from time to time, but before you could take advantage of them, they were gone. Now we are seeing the flip side. We keep seeing slight signs of a rally, only to be disappointed again. Nearly everybody seems to agree that this is a short term slow down in the middle of a long term growth cycle, however, the news just keeps getting worse, and the end keeps getting a little further away. So when will it end.

We warned last year that this might happen. We said that all the fed tightening would be slow to take effect and was likely to be the wrong action, as high-energy prices would probably have a slowing effect, not a long-term inflationary effect. We think that the effects of last years tightening are not fully through the system yet. We also believe that energy costs have peaked. However, it takes a long time for increased energy costs to filter through the economy, and that process is not complete yet either. Considering this and that the fed has been slow to ease its monetary policy, we suspect that a turn around will not be seen till late in the year. Having said that, remember it is always darkest before the dawn.

When all hope seems to be lost and everyone seems certain that we are in for a continued recession, chances are you are seeing the best signs of a turnaround. So all this bad news may not be a bad thing. We think that a year from now all this will be forgotten and the record expansion will be continuing again. Actually, the only thing we are not sure of is the timing part. We are very confident that the current doom and gloom will end, it might happen tomorrow, or maybe not for two years, but probably not for a few months.

In the mean time, we are being presented with a buying opportunity, although, it is our belief that it is nearly always a buying opportunity for something. So our approach stays the same. Or as one good friend often says to us, "Nothing Changes." Stick to our four IFC Investment Principles and do not let the current situation dictate your strategy. A good quality balanced diversified portfolio is still the best way to go.

Return to top of page.

Return to Financial Insight's main page.

![]()

![]()

We must confess that we are taking a little satisfaction lately. All around us is the news about what a dismal year it was especially for technology stocks. We note that the headline on the Report On Business section of the Globe And Mail on January 1, 2001 was Tech wreck 2000. This is similar to most of the news that we have been hearing.

We take some satisfaction for a couple of reasons.

First, at the beginning of the year 2000, all the news was about how great the market was and how everyone was making a killing in Technology. The attitude was that all the rules had changed, and that people like us who stuck to their guns and applied the old rules were just being foolish and ignoring the new realities. We must admit it was not easy sticking to those guns, let alone publishing our position. Essentially our position was that the old rules did apply, that many of those who ignored them would get burnt and that it was as important as ever to stick to our four IFC Investment Principles. So we must confess that we feel vindicated. To see what we actually said and read our recommendations from our January 2000 issue, you can take the link from the index above to our repost of last January's issue.

Second, there is the satisfaction of success. In 2000, the TSE went up about 6%, the DOW dropped about 6%, the S&P 500 dropped about 10% and the Nasdaq dropped almost 40%. These numbers explain the headlines we have been hearing. However, we are happy to note that while we will not reveal the details, all our portfolio's made money in the year 2000 and our personal portfolio had a return of about 26%, with a three year average annual compounded return of over 15%. Compared to Canadian Equity mutual funds, that put us in the top 5% for the year and 10% for our three year average annual compounded return. Needless to say, we are pleased that we were foolish enough to stick to our principles and bucked the trend.

Enough about us, let us take a look at where we have been and where we are going. Historically, on average, stocks return about 10 percent per year. So over the long term, this is the sort of return you should expect from your stock portfolio, less a couple of percent for mutual funds to cover the management expenses. This may sound low, but in times of normal inflation of about 3 percent, it is about three times the rate of inflation, and triple the rate of inflation is nothing to scoff at. Actually, we would prefer to make 10 percent with 3 percent inflation than 18 percent with 10 percent inflation. We should also expect a lot of volatility. You cannot expect to get 10 percent every year. Many years, maybe even most, you get over ten percent which makes up for the years when you lose money. In the end, an average of 10 percent per year is a reasonable expectation for a stock portfolio.

In that light, 2000 was not a good year, but certainly something to be expected. The following link is to a chart showing the TSE 300, Dow Jones Industrial average, Standard & Poors 500 and Nasdaq composite index year-end closes for the last 7 years.

The average compounded annual returns for the period (excluding dividends) are as follows:

TSE 300 = 10.9%

DOW = 16.3%

S&P = 16.0%

Nasdaq = 18.0%

We choose 7 years because at a 10% return an investment should double in about 7.2 years. As you can see, the last seven years have been phenomenal. Historically speaking, this has truly been an exceptional period, even after the Tech Wreck 2000. Add one to two percent to the TSE, DOW and S & P for dividends and the returns are even more impressive. Most of the shares in the Nasdaq do not pay dividends so the above return pretty closely matches its total return.

We expect that technology will continue to drive the future, as it has for generations. However, it is not always technology companies that benefit from technology. The biggest benefactors are usually the companies that use the technology, not the creators of the technology. After all, the technology only has value if someone can use it to their advantage. Also, the rate of technological advance suggests that a new breakthrough can easily become obsolete before its creators can reap the rewards of creating it.

In the future, we expect that there will be an ongoing rotation where different sectors and companies will move in and out of favor. This means that if you can pick the right sector at the right time, you will make a killing. However, as we have said before, there are more ways to be wrong than right, and if you get it wrong, you will likely eliminate any gains you made and probably lose money in the process. However, picking good companies with good prospects is a realistic objective. If you do that, most of your picks will probably make you happy in the long run, as long as you hold on to them. They may not always move the way you expect them to, but overall the direction should be the right one. Who can ask for anything more?

So we are long term bullish and if you have not guessed, our standing advice continues to apply. Stick to our four IFC Investment Principles, in the end we believe you will be glad you did.

Return to top of page.

Return to Financial Insight's main page.

![]()

![]()

The following are some of the statements that we made near the beginning of the year, when there seemed to be no stopping the market, especially the high tech sector. At the time, many people could not wait to get into the market and make their fortune in technology stocks.

In our October 1999 issue, in an article discussing if stocks were overvalued, we commented on the "This Time it is Different" phenomenon. We said:

"There are also some that claim that the world has changed and that the old methods of evaluating stocks no longer apply. They are what you might call the flip side of the doom and gloomers. They believe that the tremendous rates of growth are sustainable, and that it is a mistake to apply the old measures to the new economy and especially the new technology. They believe that this time it is different. Well we have heard that before, and it is not. We are not even leaving room for discussion on this. The basic rules still apply, and those who choose to ignore them will get burnt. This is not to say that PE's cannot be higher, but we have already discussed that. Nevertheless, there are certain rules that always apply, and we have seen nothing to change them. These are rules like; Companies cannot carry unlimited amounts of debt, or a stock's price will eventually reflect earnings."

In our January 2000 issue, (a copy of which is linked from the index above), we discussed a number of events that had occurred over the previous twenty years, and noted that there were some striking resemblances to the current time. Some of the events we noted were:

We went on to point out, that technology stocks were all the rage and that many people were claiming that traditional valuations no longer applied. We stressed that technology has always changed the world and would continue to and that this was nothing new. We indicated that, as in the past, there would be setbacks and that a 20 percent correction was very likely. We pointed out that sooner or later many people will get burnt by those hot technology companies, that we expected that there would be some sector rotation in the future, and that our four IFC Investment Principles were as important as ever.

In our March 2000 issue, in the Your Questions section, we explained how a breakdown in the technology sector could happen. We said: